Milano, via Verro

Milan, via Verro offers an investment opportunity in an initiative for the acquisition, demolition and reconstruction of a residential complex consisting of 19 residential units. Located in a rapidly growing neighborhood in Milan, the project represents an investment opportunity through preferential equity.

Investor funds will be used to finance acquisition and restructuring costs (CAPEX). The main characteristics of the project are the following:

- 30.5% expected ROI

- 12.5% IRR (compound annual rate)

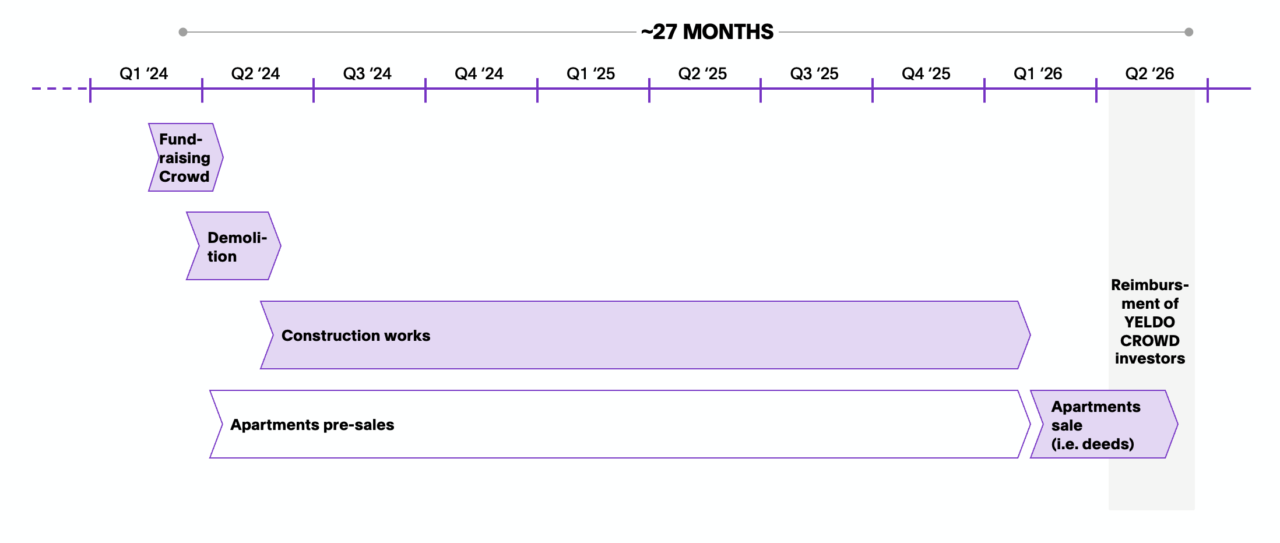

- 27 months expected duration

- Start of construction works by June ’24 and expected duration below 2 years

The returns indicated are intended as expected returns, gross of taxation on the distribution during redemption and the one-off investment fee:

- 1.5% for tickets under €25,000

- 1.0% for tickets greater than or equal to €25,000.

Executive summary

The project involves the acquisition and demolition of a commercial property with subsequent reconstruction and sale of a residential complex of 19 residential units in via Verro in Milan.

The property is located near the brand new SouPra district (South of Prada), also known as Fondazione Prada, a residential area experiencing strong growth and expansion which is preparing to welcome the Olympic Village for Milan-Cortina 2026 nearby.

The asset has a commercial surface area of~1,598 m2. The project involves the sale of 19 units and 10 garages and parking spaces, as well as 13 cellars.

The building permit is a SCIA art. 23, whose effectiveness is already consolidated. The start of demolition is expected in March '24, the start of construction work by June '24, and the end of the work is expected by the end of '25.

The asset has a commercial surface area of~1,598 m2. The project involves the sale of 19 units and 10 garages and parking spaces, as well as 13 cellars.

The building permit is a SCIA art. 23, whose effectiveness is already consolidated. The start of demolition is expected in March '24, the start of construction work by June '24, and the end of the work is expected by the end of '25.

Points of strength

- 12,5% expected IRR

- Break-even point to repay investors’ capital requiring to sell at merely 4.062€/mq (-28% vs BP), way below market average

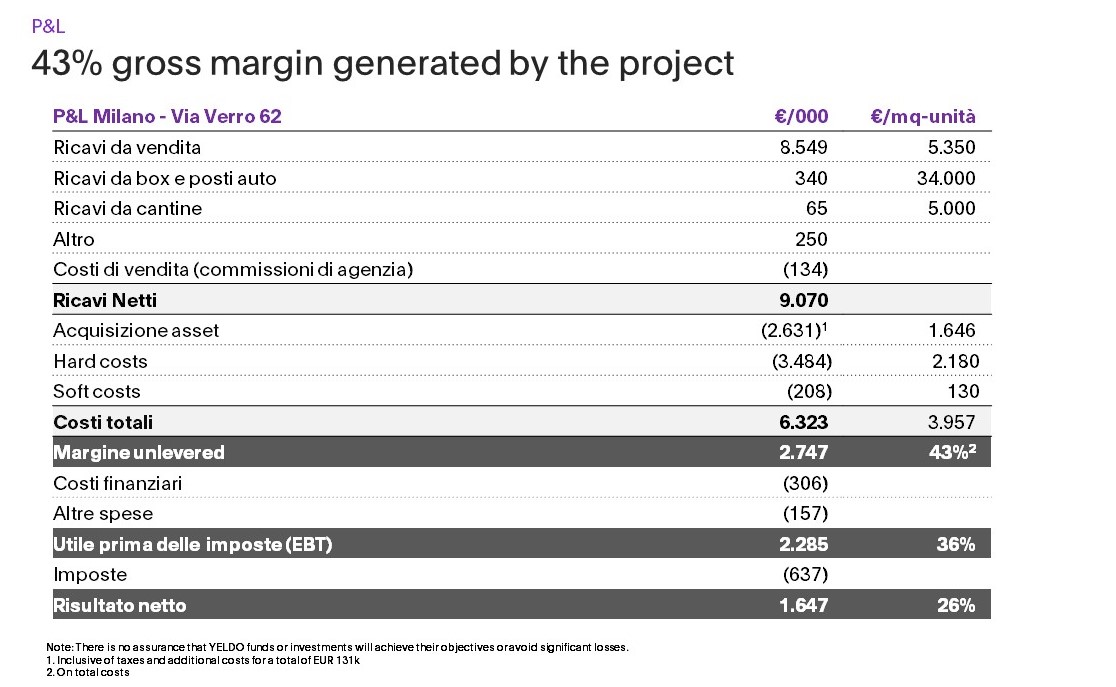

- 43% unlevered margin (on total costs) equal to EUR 2,7M

- Break-even point to repay investors’ capital requiring to sell at merely 4.062€/mq (-28% vs BP), way below market average

- Building permit (SCIA art.23) already obtained, thus eliminating administrative risk

- Sponsor with strong and extensive experience in the sector, backed by a solid group (Genesi Holding)

- The property is located near the brand-new district known as Fondazione Prada, an area undergoing significant redevelopment and that will host the Milan Cortina 2026 Winter Olympics

- Reconstruction of Torre dei Moro (recently burnt) has begun, with a positive impact on the micro-zone

- Units are being marketed by DILS, a leading broker in the Milan.

The asset

The initiative, lasting 27 months, involves the demolition and reconstruction of a residential complex comprising 19 apartments and 10 parking spaces, as well as 13 storage units. The project entails the creation of various types of housing: one-bedroom, two-bedroom, and three-bedroom apartments overlooking the internal courtyard.

The units, with a triple A energy efficiency rating, will feature modern finishes and amenities (e.g., home automation, underfloor heating, etc.). The property will be located in a neighborhood undergoing significant urban regeneration, potentially enhancing its exit value

The units, with a triple A energy efficiency rating, will feature modern finishes and amenities (e.g., home automation, underfloor heating, etc.). The property will be located in a neighborhood undergoing significant urban regeneration, potentially enhancing its exit value

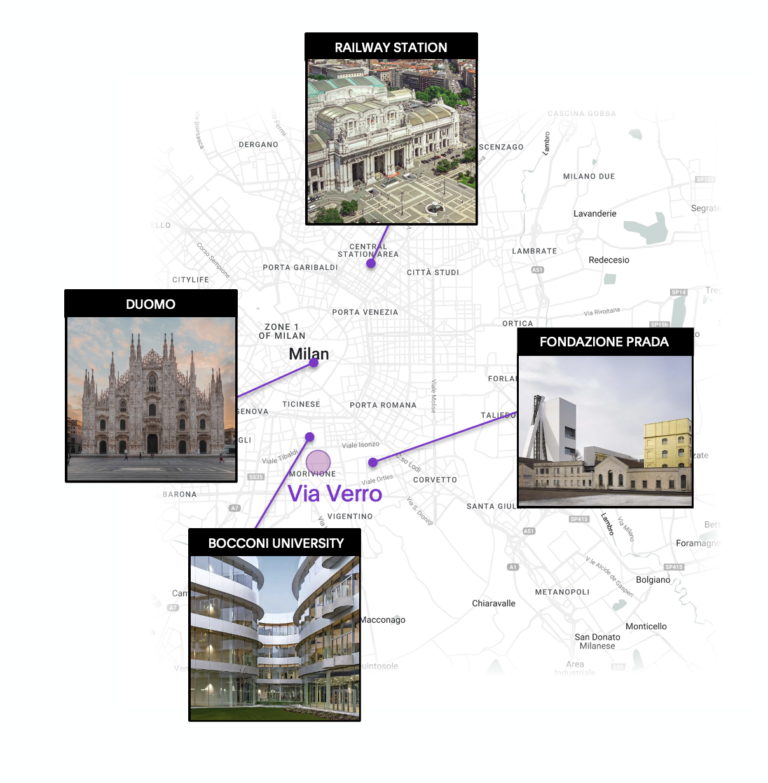

The location

- The property is located near the brand-new district of SouPra (South of Prada) in Milan, a neighborhood characterized by artistic energy and new influences. Under continuous development, the area is undergoing significant revitalization, thanks to its proximity to Scalo di Porta Romana and the construction of the village that will host the 2026 Milan Cortina Winter Olympics. The rebirth of Torre dei Moro (recently burned down) will have a positive impact on the micro-zone

- The property is well-connected being only 1.6km from Bocconi University and 2.5km from the nearest metro station, as well as being 20 minutes away from the Rogoredo railway station

- Its proximity to the university area and Porta Romana, along with the dense presence of commercial and recreational activities, make the residential units ideal for a wide clientele, attracting professionals, families, and students alike.

The sponsor

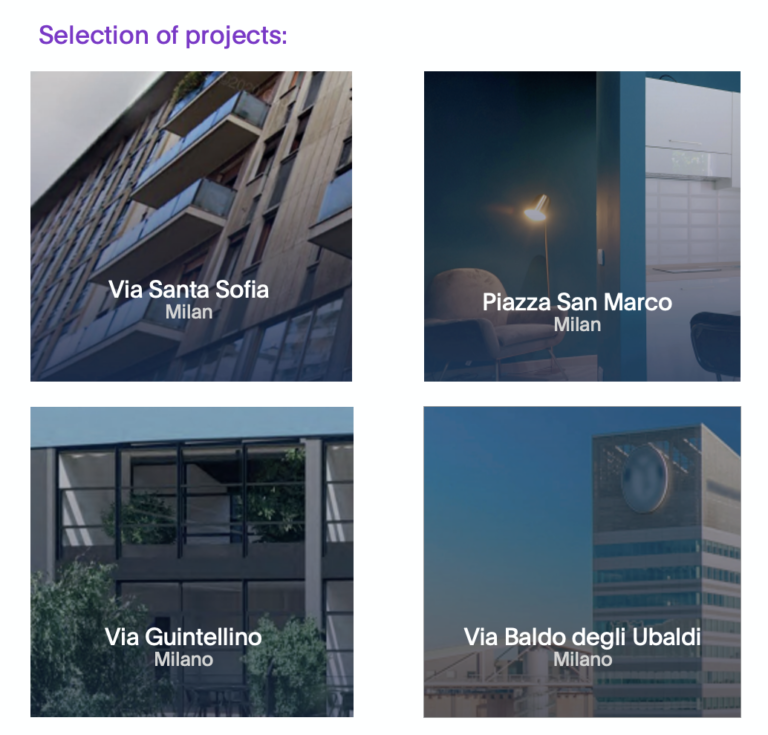

Apeiron stems from extensive experience in acquiring and developing real estate operations in Milan and other major cities across Italy.

Apeiron provides comprehensive residential real estate services, ranging from research and development to sales, utilizing futuristic urban and landscape architectural design, with a focus on design and services offered.

Apeiron is the real estate branch of Genesi Holding, a group with a focus on insurance brokeraging

As of today:

4 completed projects

1,000-10,000 m2: the target for real estate transactions

Milan: the main geographical focus

As of today:

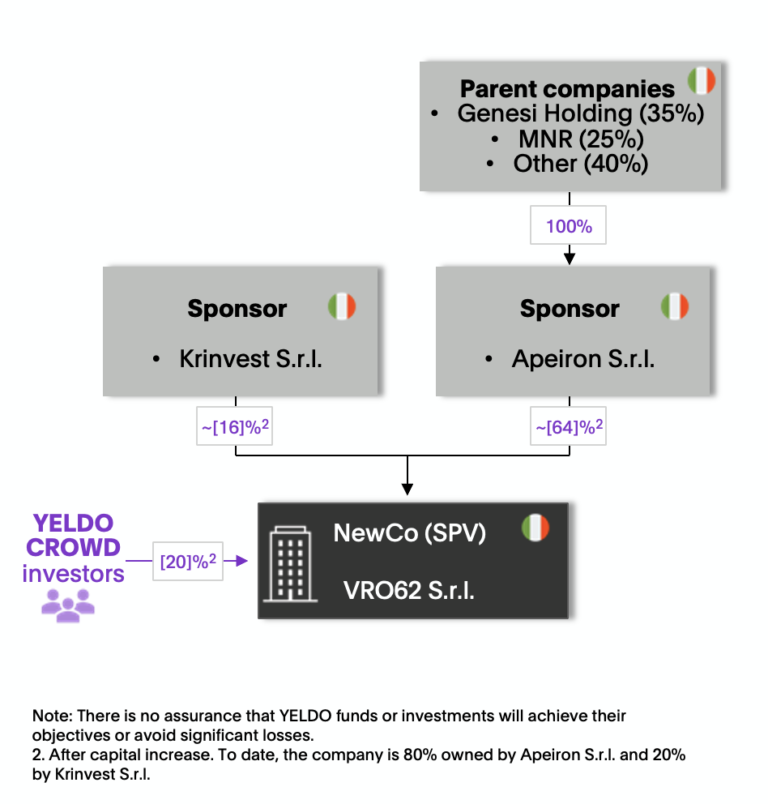

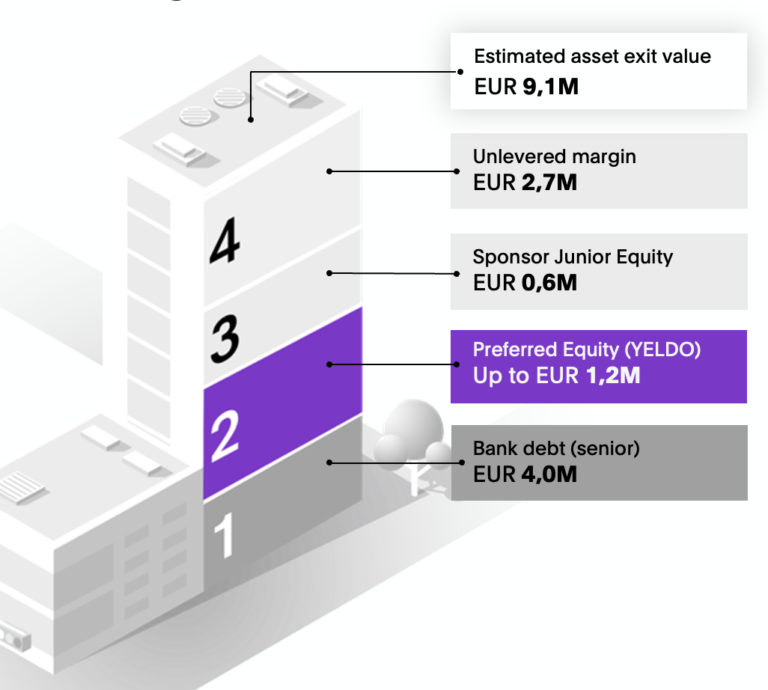

Deal structure

YELDO CROWD investors enter NewCo VRO62 S.r.l. with a capital increase with preferential equity.

At VRO62 S.r.l. level, 2 share classes are foreseen, i.e.

At VRO62 S.r.l. level, 2 share classes are foreseen, i.e.

Class A : ordinary shares of the Sponsor, with full administrative rightsClass B : YELDO Investors, 12,5% IRR, with a 1,08x minimum cash on cash in case of early reimbursement, with no administrative rights over ordinary management

Liquidation preference : YELDO investors’ capital and return benefit from a liquidation preference vs Sponsor equityPut-option : YELDO investors have the option to sell their shares to the Sponsor if, at the 27° month, both capital and returns have not yet been reimbursed. YELDO CROWD investors will have the right to sell their shares to the Sponsor at a price equal to the invested capital plus the accrued return if reimbursement has not yet occurred.Equity commitment agreement : the Sponsor will ensure the financial sustainability of the project by injecting additional equity if necessary, covering any cash shortfallsSelf-liquidating shares : when YELDO investors have received profits and/or reserves sufficient to cover their entire due amount, their shares shall automatically extinguish

Waterfall of payments

YELDO preferred equity shielded by €3.3M (Junior Equity + Gross Margin).

After repayment of the bank debt, the order of payments will include:

The break-even point, i.e. the percentage of revenues from sales vs. Business Plan to be made to repay the capital of YELDO CROWD investors is equal to 72%, or €4,062/m2.

After repayment of the bank debt, the order of payments will include:

- YELDO CROWD investor capital (preferred equity)

- YELDO CROWD investors' expected return

- Junior equity and sponsor margin

The break-even point, i.e. the percentage of revenues from sales vs. Business Plan to be made to repay the capital of YELDO CROWD investors is equal to 72%, or €4,062/m2.

Timeline

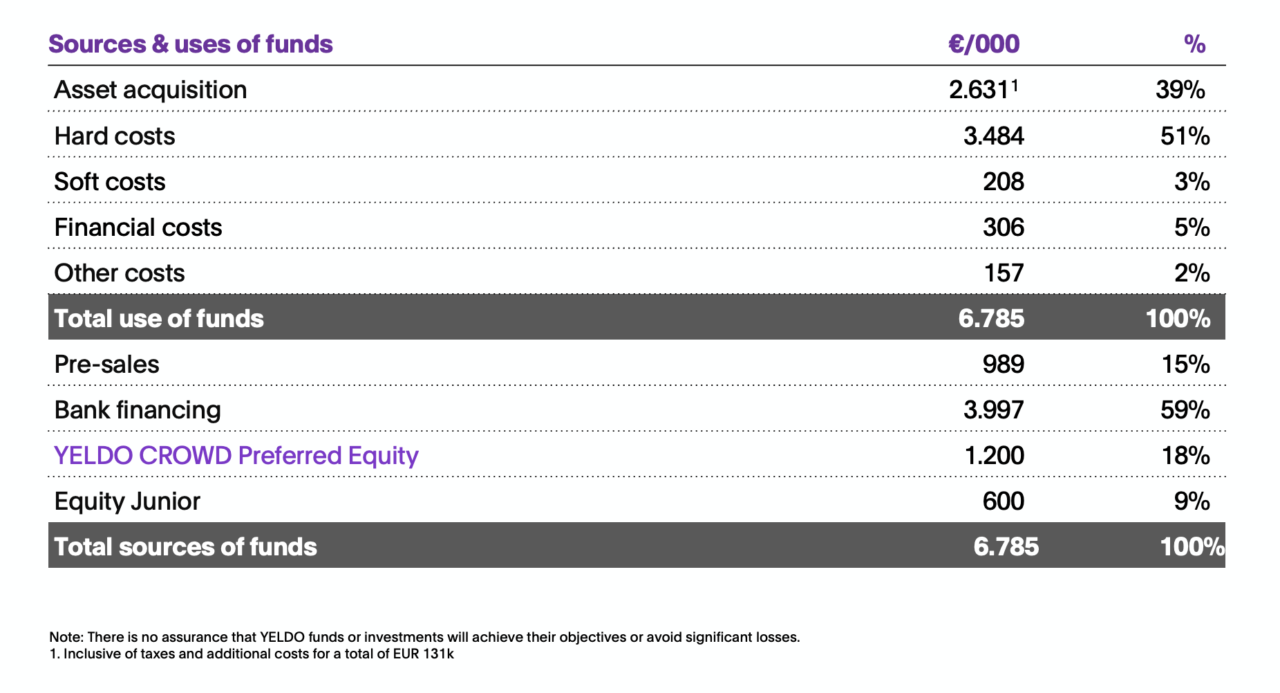

Sources and uses

P&L

The Relevant Parties of Y-Crowd S.r.l., as defined in the Conflict of Interest Management Policy available on the website at the following link may invest in the Offering at the same terms as other investors, without receiving preferential treatment or privileged access to information, within the limits established by the same policy.

Italian

Italian English

English