FAQs

Frequently asked questions

YELDO CROWD is the equity crowdfunding platform, authorized by CONSOB, which allows you to access investments selected real estates with a minimum ticket of 10,000 euros. YELDO CROWD is part of the YELDO Group: born in 2018, YELDO selects the best real estate projects in Europe, offering professional investors direct access to investment proposals previously accessible only to a few. To date we operate in Germany, Switzerland and Italy and have financed projects worth over 500 million euros. Our mission is to democratize the Real Estate market, offering direct access to real estate investments, an investment class historically accessible only to a few: with YELDO CROWD we extend our services to retail investors, with investments starting from 10,000 euros.

Equity crowdfunding is a form of risk capital investment that allows investors to finance unlisted companies, such as startups or small and medium-sized businesses, in exchange for a shareholding. This modality offers companies the opportunity to raise funds to develop, while investors can obtain a direct participation in the supported projects.

Real estate equity crowdfunding is a form of equity crowdfunding aimed at specifically financing real estate projects, such as for example the construction, renovation or redevelopment of buildings for residential, commercial or logistical use, the subdivision of large real estate units into several smaller units or even a change in intended use.

Compared to traditional equity crowdfunding investments, those in the real estate sector offer investors the benefits and advantages of investing in real assets: diversification and low correlation with the performance of the financial markets, as well as hedging against inflation, thanks to the presence of a real underlying asset, which maintains its value over time.

The IRR (Internal Rate of Return) indicates the annual return of an investment.

Used for the valuation of financial and real assets, from a mathematical point of view the IRR corresponds to the discount rate which makes the current value of an investment null.

The IRR indicated in the YELDO CROWD campaigns represents the expected annual rate of return on the investment, calculated using a compound interest rate with annual capitalization of the returns already accrued.

ROI (Return on Investment) is a financial indicator that measures the total return of an investment compared to the initial capital.

Calculated as a percentage ratio between the accrued returns (i.e. the return) and the initial investment, the ROI represents the rate of return on the total invested in an operation.

The expected duration is the length of time the investment is expected to remain active before being repaid.

The cascade of payments indicates the order of priority with which the different parties involved in an operation will perceive the cash flows arising from the operation itself. In other words, the payment cascade hierarchically establishes who has priority in payments.

In the context of an equity crowdfunding investment, the payment cascade therefore describes the order in which the various parties involved will be reimbursed and in particular when investors will receive the reimbursement of invested capital and the related accrued returns.

The liquidation preference, or preferential reimbursement, is a clause that offers a payment priority over other parties involved in the operation, such as other shareholders or investors. The beneficiaries of a liquidation preference are placed in a preferential position compared to other subjects in the payment cascade and will therefore obtain a payment priority at the time of exit or, in correspondence with other reimbursement events.

A restricted account is a type of bank account whose funds are blocked for a pre-established period, without the owner being able to freely dispose of them until the restriction expires.

In YELDO CROWD’s equity crowdfunding projects, the sums paid by investors are initially channeled into a restricted account, established by the promoter at Banca Finint, our partner banking institution.

During the collection campaign the account remains inaccessible, both to YELDO CROWD and to the beneficiary of the campaign itself. Only after the successful conclusion of the campaign will these sums be released and made available to the promoter, who will use them as foreseen by the project.

YELDO CROWD is an equity crowdfunding platform authorized by the National Commission for Companies and the Stock Exchange (CONSOB), and which operates in compliance with the established laws and regulations. The platform is subject to the supervision and control of CONSOB, which guarantees its reliability and quality of service, to protect investors.

A Professional Investor is someone “who has the experience, knowledge and competence necessary to consciously make his own investment decisions and to correctly evaluate the risks he assumes” and his involvement in crowdfunding campaigns represents a protection for investors retail investors. The Professional Investors by right are:

- (1) the subjects who are required to be authorized or regulated to operate in the financial markets, whether Italian or foreign such as:

-

- a) banks;

- b) investment firms;

- c) other authorized or regulated financial institutions;

- d) insurance companies;

- e) collective investment undertakings and management companies of such undertakings;

- f) pension funds and management companies of such funds;

- g) own-account traders of commodities and commodity derivatives;

- h) subjects who exclusively carry out trading on their own account on financial instruments markets and who indirectly participate in the settlement service, as well as in the clearing and guarantee system (locals);

- i) other institutional investors;

- l) stockbrokers;

- (2) large companies that have at least two of the following size requirements at the individual company level:

- (3) institutional investors whose principal activity is investing in financial instruments, including entities dedicated to the securitization of assets or other financial operations.

-

- balance sheet total: EUR 20 000 000.

- net turnover: 40 000 000 EUR;

- own funds: EUR 2 000 000;

Professional Investors on request are individuals who request to be treated as a Professional Investor by right. For this to happen, the investor must meet at least two of the following requirements:

- having carried out operations of significant size on the market in question with an average frequency of 10 operations per quarter in the previous four quarters;

- have a portfolio of financial instruments, including cash deposits, worth at least EUR 500,000;

- work or have worked in the financial sector for at least one year in a professional position that requires knowledge of the operations or services envisaged.

In the case of legal entities, the above assessment is conducted on the person authorized to carry out transactions on behalf of the legal entity itself.

On November 10, the new European regulation 2020/153 on crowdfunding came into force and among the most important changes includes a new method of investor profiling. Among the most significant changes, it introduces the distinction between “sophisticated investor” and “unsophisticated investor”.

European regulation 2020/153 defines sophisticated investors as those with the following requirements:

- (1) Natural persons with at least two of the three criteria below:

-

- a) have a gross personal income of at least €60,000 per tax year or a portfolio of financial instruments, including cash deposits and financial assets, of a value exceeding €100,000;

- b) work or have worked in the financial sector for at least one year in a professional position that requires knowledge of the operations or services envisaged, or must have held an executive position for at least 12 months within legal entities that have the requirements described for legal entities;

- c)having carried out operations of significant size on the capital markets with an average frequency of 10 operations per quarter in the previous four quarters.

- (2) Legal entities with at least one of the three criteria below:

-

- a) own funds equal to at least €100,000;

- b) net turnover of at least €2 million;

- c) balance sheet equal to at least €1 million.

The sophisticated investor classification remains valid for 2 years. Investors have the burden of communicating any changes or events that modify their classification. At the end of the two years, investors will in any case have to complete the sophistication test again.

Anyone who is an adult and has a valid identity document can invest in YELDO CROWD. All potential investors, before proceeding with the subscription, are required to complete an appropriateness questionnaire, which has the objective of verifying the level of knowledge regarding financial notions, understanding of the risks associated with the investment and the ability to face possible capital losses.

The minimum investment threshold for the projects published on YELDO CROWD is 10,000 euros: registered users who have completed the appropriateness questionnaire can therefore invest starting from 10,000 euros, with increments of 5,000 euros.

YELDO CROWD invites users to invest responsibly, with amounts appropriate to their financial capabilities. We recommend that investors make thoughtful investment decisions, in line with their financial objectives and having fully understood the risks associated with the individual proposed transactions.

To make an investment in YELDO CROWD you must complete the following steps:

- Register or log in: register your profile at https://www.yeldocrowd.com/ profile/ or log in using your account. You can use your email address and choose a password to register, or log in with Facebook, Google or LinkedIn.

- To activate your account and start investing, confirm your email address by clicking on the link you will receive via email to the address provided during registration (this phase will not be necessary with Facebook, Google or Linkedin login). If you have already created an account, access the profile by logging in with the email credentials and password chosen previously.

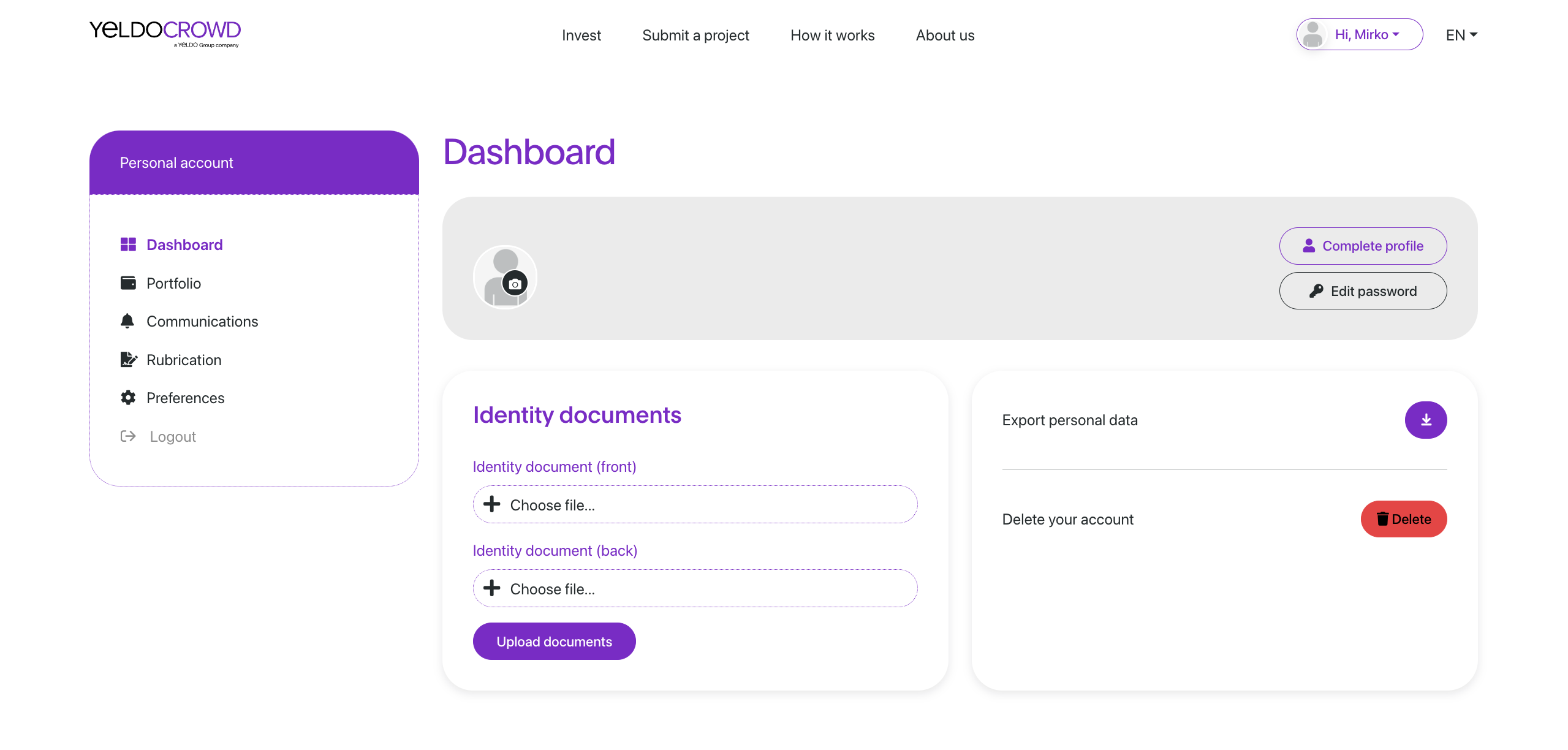

1. Complete or update your investor profile: access your personal area available on the page https://www.yeldocrowd.com/profile / and enter your personal details, residence and contact details. Take a photo in selfie mode and upload a copy of a valid identity document (identity card or passport) front and back, making sure all the details are well readable.

2. Complete the sophistication test, declaring in this section your status as a “professional, “sophisticated” or “unsophisticated” investor

3. Complete the anti-money laundering questionnaire

4. If, following the test, you are found to be an unsophisticated investor, you will have to complete a further step: the adequacy test and the loss tolerance test available on the bulletin board page.

Remember that you can always update your information by clicking on the “Edit profile” button available at the link https://www.yeldocrowd.com/profile /preferences/

The appropriateness questionnaire consists of a series of questions aimed at ascertaining the investor’s level of experience on the financial markets, his preparation with respect to investment-related issues and his propensity for risk.

The questionnaire verifies in particular that the level of experience and knowledge of the markets is adequate to fully understand the risks associated with the investment. This step is not required if you want to operate with an investment profile validated as a sophisticated or professional investor.

Through the answers provided to the questionnaire, the portal evaluates the appropriateness of the potential unsophisticated investor: in the event that the user does not possess sufficient knowledge, skills or experience, the portal informs him that the proposed instruments may be inappropriate for him and his The investor will be required to expressly accept a specific risk warning provided by the portal. Additionally, unsophisticated investors deemed inappropriate may be subject to investment amount limits of 5% of their net worth as calculated through the loss bearing capacity simulator.

Receiving a negative outcome to the appropriateness questionnaire is not blocking and does not prevent you from proceeding with the investment: if your appropriateness questionnaire had a negative outcome you can still proceed with the investment on YELDO CROWD. If negative, during the investment phase, the system will ask you to confirm your intention to proceed with your choice several times. We recommend that you delve deeper into the risks associated with investments, to make conscious and informed decisions in line with your financial availability, your risk-return profile and your short, medium and long-term investment goals. You will be able to repeat the questionnaire after 30 days.

Investing with YELDO CROWD is quick and easy. Here’s how: Select the campaign you’re interested in. In the “Invest” section of the site https://www.yeldocrowd .com/projects/) and access the project tab to get more information on the operation.

-

- 1. Select the “INVEST NOW” button, available on the page dedicated to the project.

- 2. Choose the amount you wish to invest, starting from 10,000 euros, in increments of 5,000 euros.

- 3. Confirm your phone number using the OTP code you will receive via text message.

- 4. Confirm the amount to invest.

- 5. Choose whether to register the investment through our partner Directa SIM. We remind you that this is a non-mandatory step.

- 6. Read the general terms and conditions of use and the privacy policy, then confirm your investment.

- You will immediately receive a confirmation, on the screen and via email, where you will find:

- the bank details for the payment of the amount to be invested: amount of the payment to be made, bank details of the account to which the payment is to be made, beneficiary, name of the bank that holds the issuer’s unavailable account

- the summary of the subscription request: project name, amount you intend to invest, investment fee, date and time of subscription request

- We remind you that you have the possibility to carry out a simulation of your investment by clicking on “simulate investment”, present on the project page, to have a complete overview including initial investment, expected investment duration, final distribution, returns and investment fee.

The investment receipt, which contains all the summary information and bank details useful for making the payment, is available for download on the confirmation page at the end of the investment process, and is sent simultaneously via email a few moments later. If you cannot find the email, check the “junk mail” or “spam” folder in your inbox, or write to us at info@yeldocrowd.com and we will resend you the instructions needed to complete your investment.

The investment receipt, which contains all the summary information and bank details useful for making the payment, is available for download on the confirmation page at the end of the investment process, and is sent simultaneously via email a few moments later. If you cannot find the email, check the “junk mail” or “spam” folder in your inbox, or write to us at: info@yeldocrowd.com and we will resend you the instructions needed to complete your investment.

After completing the investment process and arranging the transfer to the unavailable Banca Finint current account dedicated to the operation, you will see your investment “awaiting” within the private area on YELDO CROWD. The amount will remain on hold for a few days, until we have completed the reconciliation procedures in collaboration with Banca Finint. These procedures can take up to 7-10 days, as the bank shares with us the statement of incoming bank transfers to the unavailable account on a weekly basis. Once the reconciliation is complete, you will receive a confirmation email and the status of your investment will change to “confirmed”.

Investments on YELDO CROWD include an investment fee, specified in the details of each project, which helps cover the management costs of the platform. To find out the exact amount of the commission before proceeding with the investment, use the simulator, available on the individual project page.

If a crowdfunding campaign on YELDO CROWD does not reach the minimum collection target within the established deadline, it will be considered “unsuccessful”. All funds collected up to that point in the restricted account will be credited back to the current account of origin of each investor, to whom the entire amount allocated to the investment will be returned.

When you make an investment in YELDO CROWD, you acquire shares of the company or investment vehicle (Special Purpose Vehicle or Special Purpose Vehicle) established by the promoter of the supported project. In most cases the company vehicle is represented by an LLC or Spa. The number of shares of the vehicle company acquired with your investment is regulated by the capital increase resolution, which determines the specific ratio between nominal value and share premium reserve. In other words, when you invest 10,000 euros in a YELDO CROWD project, only a part of your investment, called “nominal value”, will contribute to increasing the share capital paid into the special purpose vehicle. The difference between the invested amount and the nominal value, however, will constitute the so-called “premium reserve” and will contribute to fueling the company’s net assets.

The investment timeline on YELDO CROWD is made up as follows:

1. Investment order: corresponds to the moment in which the investment booking flow is completed. This date determines the booking order of investors and the starting date of the withdrawal deadlines

2. Investment confirmation: date on which the crediting of the invested sums is confirmed, following the reconciliation of the transfers received on the escrow account dedicated to the operation

3. Start of investment:date on which the sums collected are disbursed and made available to the real estate sponsor. This date marks the start of the investment for the purposes of calculating the expected IRR return

4. Investment reimbursement: date on which the real estate sponsor reimburses the investors, returning the invested capital and the related return. The repayment date, together with the start date of the investment, helps to determine the actual duration of the investment, used for the timely calculation of the accrued returns, defined on the basis of the IRR established in the project.

The alternative share registration regime is a special regime provided for by the Consolidated Law on Finance (TUF) for the subscription and sale of shares representing the capital of small and medium-sized enterprises established in the form of limited liability companies.

Thanks to this regime, investors who participate in a subscription offer on equity-crowdfunding portals can give an intermediary authorized to provide certain investment services a mandate to subscribe the shares on their behalf. In practice, the intermediary becomes the “formal” owner of the shares, but keeps track of the “substantial” owner of the same through internal registers. The intermediary also takes care of updating the records and issues, upon request, certificates and attestations necessary for the investor to exercise his social rights. By giving the mandate to the intermediary, investors can delegate the management of the shares and the related formalities, while still enjoying the social rights and returns expected from the investment.

The choice of activating the directory service (alternative regime of subscription and sale of shares) is optional.

Investors who join the alternative share ownership regime can:

- transfer the shares without the need to resort to the services of a notary or an accountant and without further administrative costs. The entire share transfer process will be managed by Directa Sim at no additional cost.

- remain anonymous regarding your investment. Directa SIM will be registered in the Chamber of Commerce as a nominee for third parties, while the administrative and patrimonial rights will always remain with the investor, guaranteeing maximum confidentiality.

The investor, whether a natural or legal person, who decides to join the alternative regime will still be able to enjoy the tax benefits provided by law for investments in startups and innovative SMEs, as already happens today with the ordinary share ownership regime.

For non-sophisticated investors, there is a cooling-off period of four calendar days during which they can exercise the right to freely revoke the Investment Order.

For all investors, both sophisticated and non-sophisticated, who are classifiable as consumers under the Consumer Code, there is a withdrawal period of fourteen days during which they can freely revoke the Investment Order.

Sophisticated investors who are not classifiable as consumers under the Consumer Code are not entitled to either a reflection period or a withdrawal period. To exercise this right, you must write an email to: recesso@yeldocrowd.com, within the established deadlines.

YELDO CROWD recognizes all Investors, whether natural or legal persons, the right to withdraw from the Contract. This right can be exercised freely, and without incurring penalties.

The notice of withdrawal must contain at least the following information:

- The investor’s details

- The unique order code

- The value of the investment for which the withdrawal is exercised

If the verification of the withdrawal request is successful, YELDO CROWD will instruct the banking institution to return the invested amount. The refund will take place via bank transfer from the offerer’s unavailable account to the account indicated by the investor at the time of investment.

The right of revocation may be exercised if, between the time of acceptance of the offer and its definitive closure or delivery of the financial instruments, a significant new event occurs or a material error or inaccuracy regarding the information presented is detected. on the platform. This information must be of such a nature as to influence the investment decision, in compliance with the art. 25 of the CONSOB Regulation.

The right of revocation must be exercised by sending a request to the email address revoca@yeldocrowd.com

The notice of revocation must contain at least the following information:

-

- 1. The investor’s details.

-

- 2. The unique order code.

-

- 3. The value of the investment for which the right of revocation is exercised.

-

- 4. The indication of the event in relation to which you exercise your right of revocation

Investors may exercise the right of withdrawal within 7 days from the date on which they became aware of the new material information or material error regarding the offer.

YELDO CROWD will verify the revocation request to ensure that it was made in relation to one of the foreseen events and that it was submitted within 7 days from the date on which the investor became aware of the new information.

If the verification of the revocation request is successful, YELDO CROWD will instruct Banca Finint to return the invested amount to the investor. The repayment will take place via bank transfer from the unavailable account to the account indicated by the investor at the time of investment.

The choice to join the alternative quota registration regime does not entail any change to the method of exercising the right of revocation or withdrawal from the investment.

The YELDO CROWD Team regularly sends communications on the status of investment projects. Make sure you have correctly completed all the registration steps and have given us your consent to receive newsletters. You can check this in the “preferences” section of your account:

https://www.yeldocrowd.com/profile/preferences/

The return will begin to accrue from the moment the invested sums are actually released and made available to the developer of the real estate project. This means that once the campaign has reached its objective and the project has been started, the sums collected are transferred to the special purpose vehicle dedicated to the operation (SPV). From this moment on, the period during which the return on the investment will be calculated and accrued will begin to run.

Investors as natural persons resident in Italy:

- natural persons resident in Italy are subject to a withholding tax of 26% only on the return generated by the real estate transaction (dividends). This withholding tax is applied at source by the company in which they have invested and occurs at the time of disbursement of dividends. An advantage for investors is that they do not have to declare income from this source in their tax return, since the company acts as a withholding agent.

Investors as legal entities resident in Italy:

- Capital companies resident in Italy are subject to a withholding tax of 26% only on the return generated by the real estate transaction (dividends). For profits distributed to joint-stock companies, paragraph 2 of the art. 89 of the Tuir provides for the exclusion from the formation of income within the limit of 95% of their amount. This means that only an amount equal to 5% of the return will be subject to a withholding tax of 26%. This withholding tax is applied at source by the company in which they have invested and occurs when the dividends are paid out. An advantage for investors is that they do not have to declare income from this source in their tax return, since the company acts as a tax withholding agent.

partnerships resident in Italy [account for 58.14%].

Investors as legal entities not resident in Italy:

- Non-residents coming from a state included in the “White list” (states that allow an adequate exchange of information) can be exempt from the 26% withholding tax on the entire dividend.

- If they do not belong to the “White list”, dividends may be exempt according to the Conventions against double taxation between Italy and their State of residence.

- They can request a refund of 11/26 of the withholding tax by presenting the certification of payment of the tax abroad.

This information is based on legislation in force as of March 2020 and may be subject to change. We recommend that you contact a tax advisor or accountant for a personalized assessment of taxation based on your tax situation and the investments made.

You can contact us by phone for further explanations at: 0236681290 or by email at: info@yeldocrowd.com

Italian

Italian English

English