Milano, Via Osimo: project summary

Milan, via Osimo represents a unique opportunity for YELDO CROWD investors, giving access to an operation on a rapidly growing asset class, co-living, carried out by a recognized sponsor and operator (HABYT) known for its capacity and expertis. This project involves the purchase, renovation, leasing and subsequent sale of a property in a rapidly developing residential neighborhood in Milan.

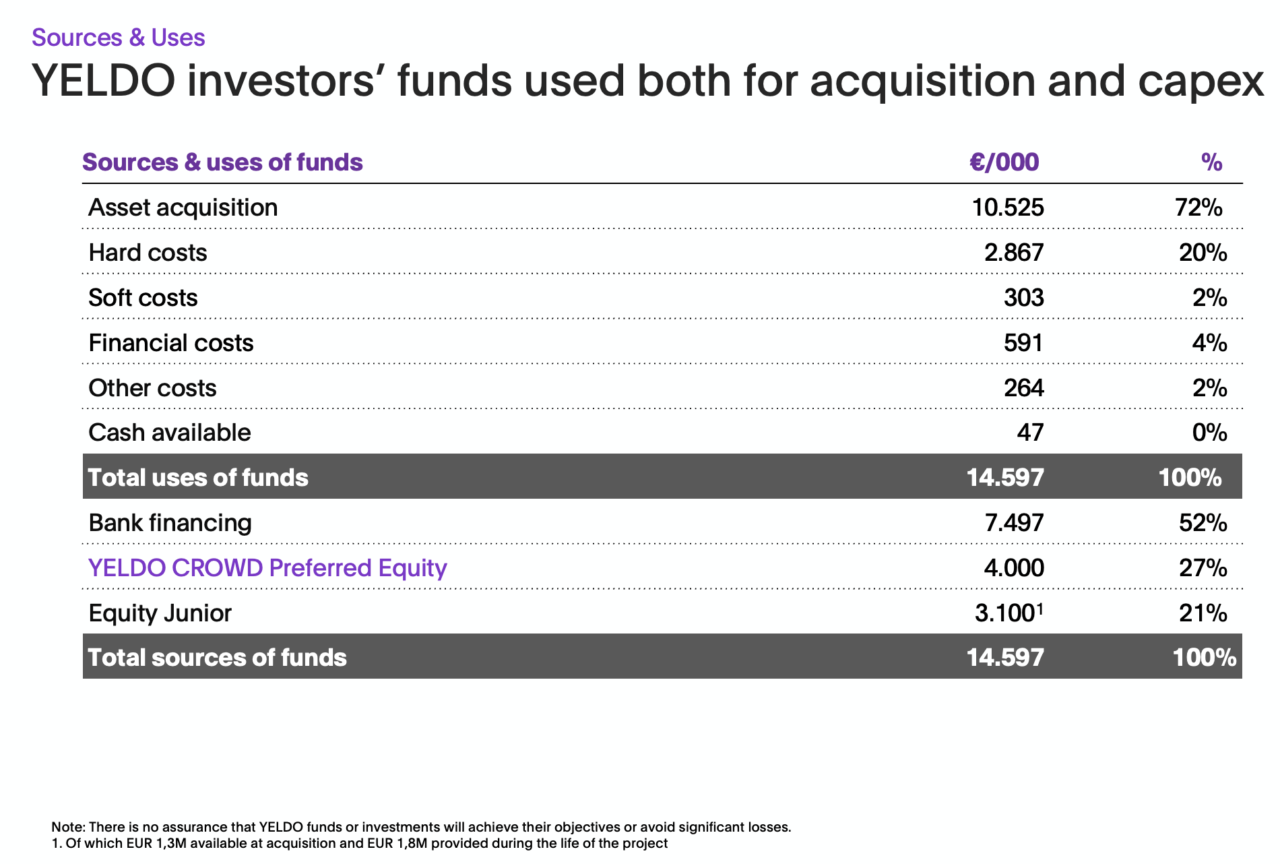

Investor funds will be used to finance part of the acquisition and capex. The main characteristics of the project are the following:

- 30% expected ROI

- 14.0% IRR (compound annual rate)

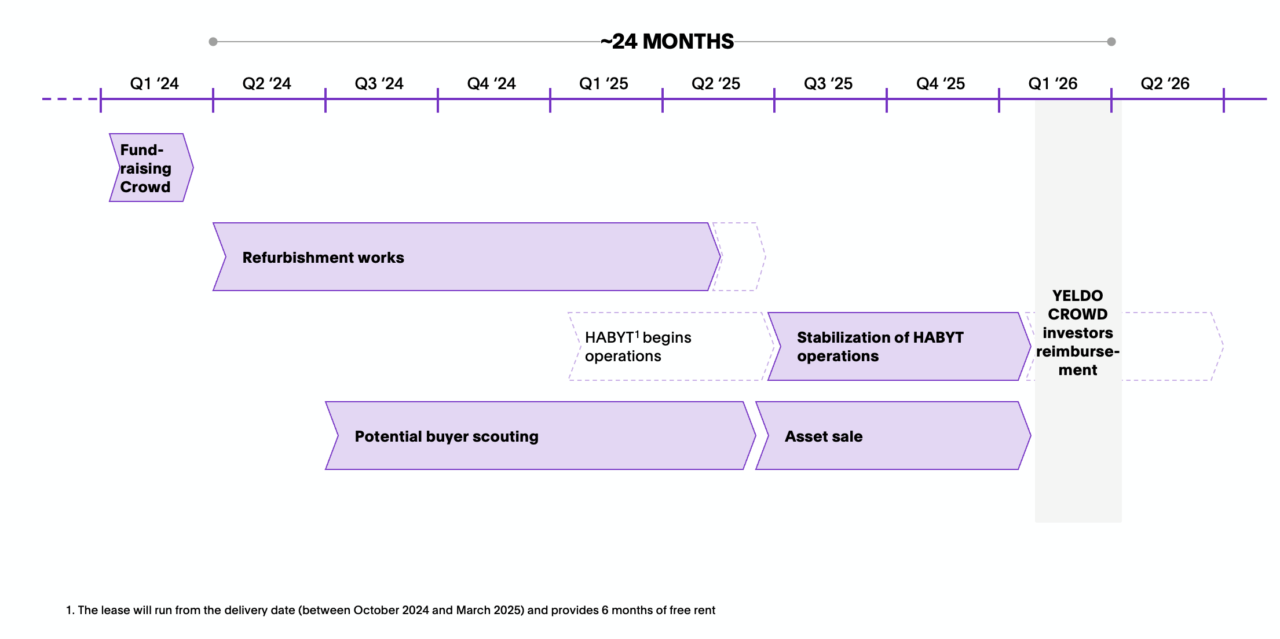

- 24 months expected duration

- start of work by April ’24 with expected completion by the second quarter of ’25

The returns indicated are intended as expected returns, gross of taxation on the distribution during redemption and the one-off investment fee:

- 1.5% for tickets under €25,000

- 1.0% for tickets greater than or equal to €25,000.

Project overview

The project entails the purchase and subsequent renovation of a Residenza Turistico Alberghiera (RTA) in Milan. The efforts are aimed at expanding the number of rooms and achieving LEED GOLD certification, promoting a sustainability-oriented approach. The property is located in a rapidly growing and expanding residential area, in the proximity of the future Milano-Cortina 2026 Olympic Village.

The asset will be equipped with 91 rooms (including 48 for residential use and 43 for hospitality use) and approx. 90 parking spaces, as well as a wide range of facilities.

The building permit is a CILA, for which the paperwork has already been registered. Work will be started by April '24 with completion expected by Q2 ‘25.

The asset will be equipped with 91 rooms (including 48 for residential use and 43 for hospitality use) and approx. 90 parking spaces, as well as a wide range of facilities.

The building permit is a CILA, for which the paperwork has already been registered. Work will be started by April '24 with completion expected by Q2 ‘25.

Strengths

- Expected IRR of 14%

- YELDO investors benefit from a solid security package including a Put-Option at month 27 by which the Sponsor grants to re-acquire YELDO investors shares

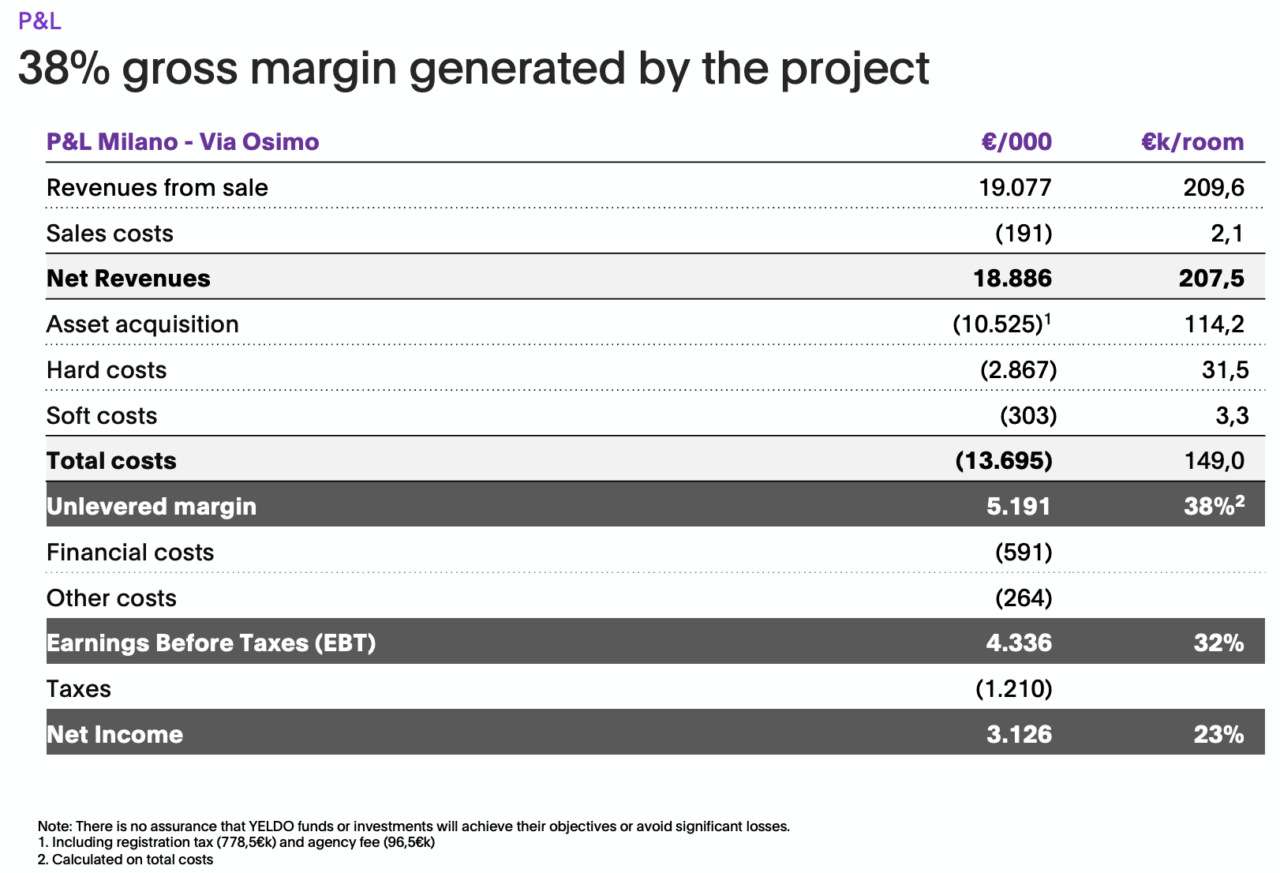

- Unlevered margin of 38% on total costs amounting to EUR 5,2M

- Break even point of YELDO investors capital reached with a cap-rate of 9.5% (vs 6.0% assumed by BP, hence 37% below BP predictions)

- The project only requires the submission of a CILA to start work, not requiring a change of use, speeding up time and eliminating all permit risks

- Lease agreement signed with HABYT, leading global player in co-living/student housing, with annual gross rent of EUR 1.15M and duration of 9+9 years

- Pre-let agreement cannot be estinguished by the Tenant for the duration of the first term, 9 years, even in case of major reasons (as allowed by Italian law “Grandi Locazioni”)

- Commercialisation by DILS, leading broker in the Italian market

- Co-living promotes energy efficiency and responsible use of resources through shared spaces, fostering the creation of inclusive communities

- Renovation in line with LEED standards that ensure the environmental sustainability of the project

The asset

This project involves the interior renovation of the property and the creation of 16 new rooms with a capex plan of €3.2 million. The facility will boast various facilities, including a gym, laundry, pool, and dining area.

The property will be equipped with 48 rooms with residential standards (> 28 smq) including a kitchenette and 43 rooms with 4-star hotel standards, for a total of 91 rooms spread over 7 floors. Furthermore, approximately 90 parking spaces are planned.

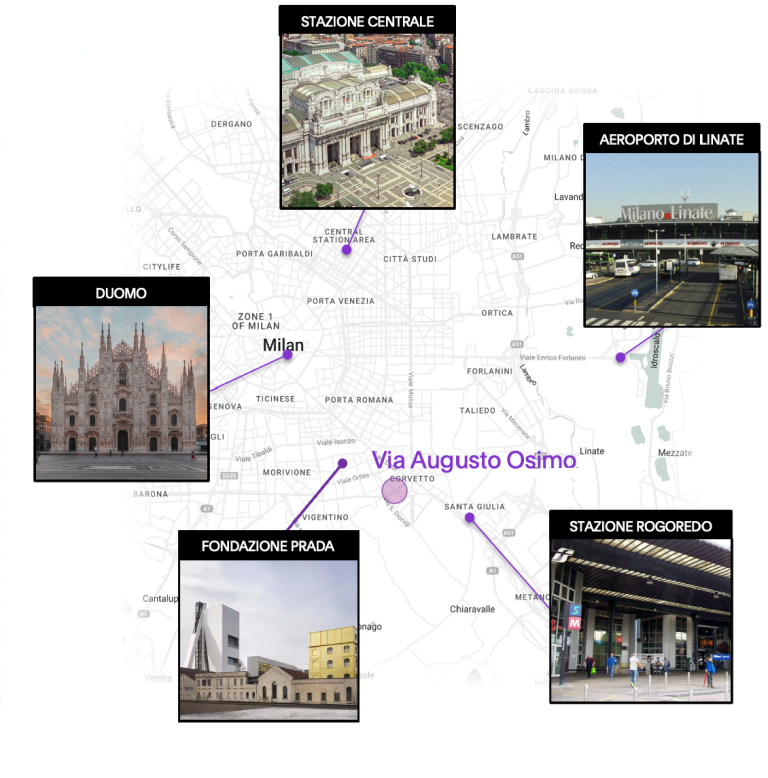

The hotel is conveniently located just a 5-minute walk from the nearest subway station. Its position is an integral part of an extensive urban development project in progress in the neighborhood, adding value to the city area and providing potential growth leverage on the investment's exit value.

The property will be equipped with 48 rooms with residential standards (> 28 smq) including a kitchenette and 43 rooms with 4-star hotel standards, for a total of 91 rooms spread over 7 floors. Furthermore, approximately 90 parking spaces are planned.

The hotel is conveniently located just a 5-minute walk from the nearest subway station. Its position is an integral part of an extensive urban development project in progress in the neighborhood, adding value to the city area and providing potential growth leverage on the investment's exit value.

The location

Lo sponsor

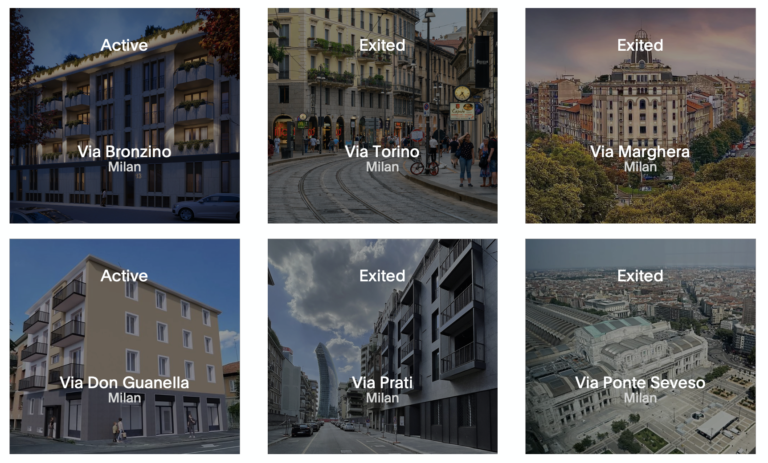

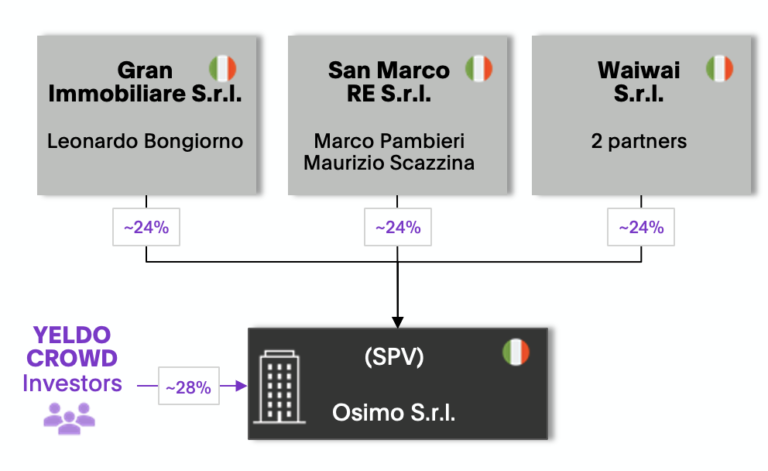

The development is promoted by 3 partners, Italian developers with solid experience in real estate developments and reconversion projects. The corporate structure is made up ofLeonardo Bongiorno, who has significant experience in real estate development projects

Marco Pambieri, with numerous real estate development projects to his credit

Waiwai s.r.l., participated by 2 partners with experience in managing accomodation properties

To date:more than 5 active projects

more than 15 projects successfully closed

geographical focus on the city of Milan

YELDO recently partnered with Leonardo Bongiorno to underwrite a EUR 7.8M bond for the Certosa project (student housing).

To date:

YELDO recently partnered with Leonardo Bongiorno to underwrite a EUR 7.8M bond for the Certosa project (student housing).

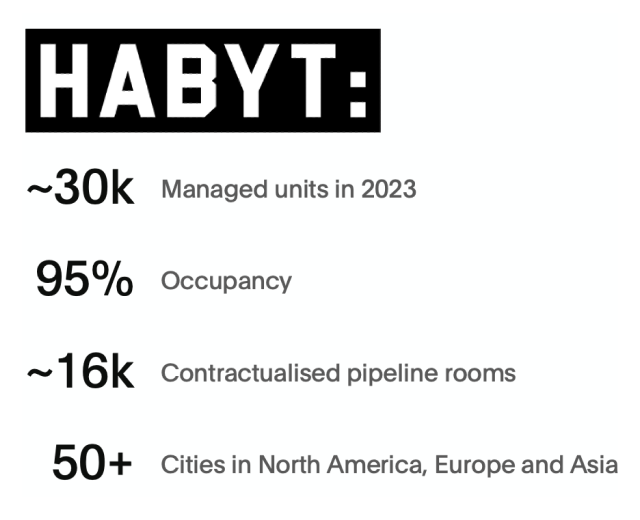

The operator

The manager is a primary international player in co-living and student housing. During 2023 it recorded 95% occupancy, in more than 50 cities in North America, Europe and Asia with approximately 16k rooms contracted pipelined.

The preliminary lease, with a term of 9+9 years, will provide for a gross annual rent of €1.15M indexed to inflation, with 6 months of free rent and a bank guarantee for an amount equal to 6 months' rent.

The preliminary lease, with a term of 9+9 years, will provide for a gross annual rent of €1.15M indexed to inflation, with 6 months of free rent and a bank guarantee for an amount equal to 6 months' rent.

Deal structure

YELDO CROWD investors joining capital increase of Osimo S.r.l., SPV set-up by the Sponsor

At Osimo S.r.l. level, 2 share classes, i.e.:

At Osimo S.r.l. level, 2 share classes, i.e.:

Class A : Sponsor ordinary shares, with full administrative rightsClass B : YELDO Investors, 14.0% IRR, with a 1.09x minimum cash on cash in case of early reimbursement, with no administrative rights over ordinary management

Liquidation preference : YELDO investors’ capital and return benefit from a liquidation preference vs SponsorPut-option : YELDO investorsequity have the option to sell their shares to the Sponsor if, at the 27° month, both capital and returns have not yet been reimbursedEquity commitment agreement : the Sponsor will ensure the financial sustainability of the project by injecting additional equity if necessary, covering any cash shortfallsSelf-liquidating shares : when YELDO investors have received profits and/or reserves sufficient to cover their entire due amount, their shares shall automatically extinguish

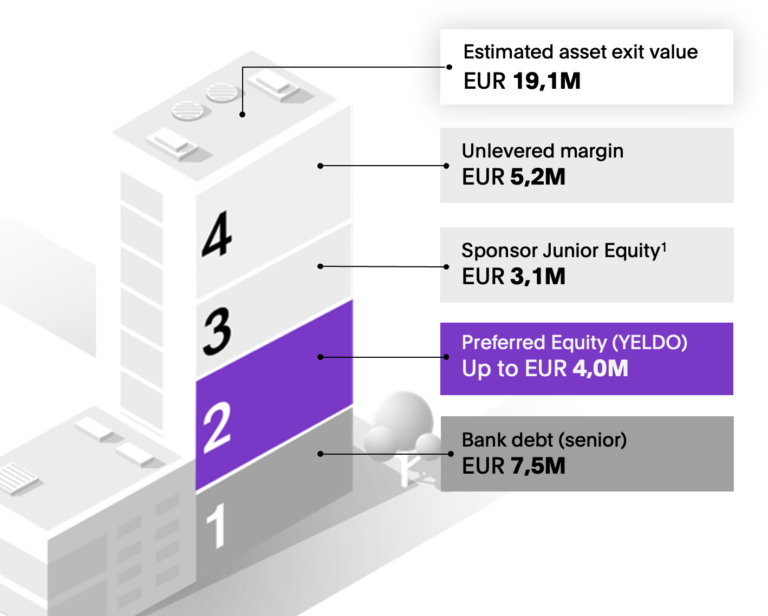

Capital structure

YELDO preferred equity protected by €8.3M (junior equity + gross margin).

After repayment of the bank debt, the order of payments will include:

The break-even point, i.e. the percentage of revenues from sales vs. Business Plan to be made to repay the capital of YELDO CROWD investors is equal to 63%, equivalent to a net capitalization rate of 9.5% (vs. 6.0 % of the BP, i.e. selling the property at -37% compared to the BP).

After repayment of the bank debt, the order of payments will include:

- YELDO CROWD investor capital (preferred equity)

- YELDO CROWD investors' expected return

- Junior equity and sponsor margin

The break-even point, i.e. the percentage of revenues from sales vs. Business Plan to be made to repay the capital of YELDO CROWD investors is equal to 63%, equivalent to a net capitalization rate of 9.5% (vs. 6.0 % of the BP, i.e. selling the property at -37% compared to the BP).

Timeline

P&L

Sources & Uses

The Relevant Parties of Y-Crowd S.r.l., as defined in the Conflict of Interest Management Policy available on the website at the following link may invest in the Offering at the same terms as other investors, without receiving preferential treatment or privileged access to information, within the limits established by the same policy.

Italian

Italian English

English