Courmayeur, Via Regionale

Courmayeur, Via Regionale is an investment opportunity in a residential refurbishment development project in Courmayeur.

Situated in a prime tourist location, the project is located only 1 minute walk from the historic town center and 4 minutes from the ski lifts. The project involves the refurbishment and sale of a complex in Courmayeur for a total of 4 residential units and 1 commercial unit other than related boxes and parking spaces.

Investor funds will be used to finance the acquisition CAPEX. The main features of the project are as follows

- 24.8%: Expected ROI

- 13.5%: Expected IRR

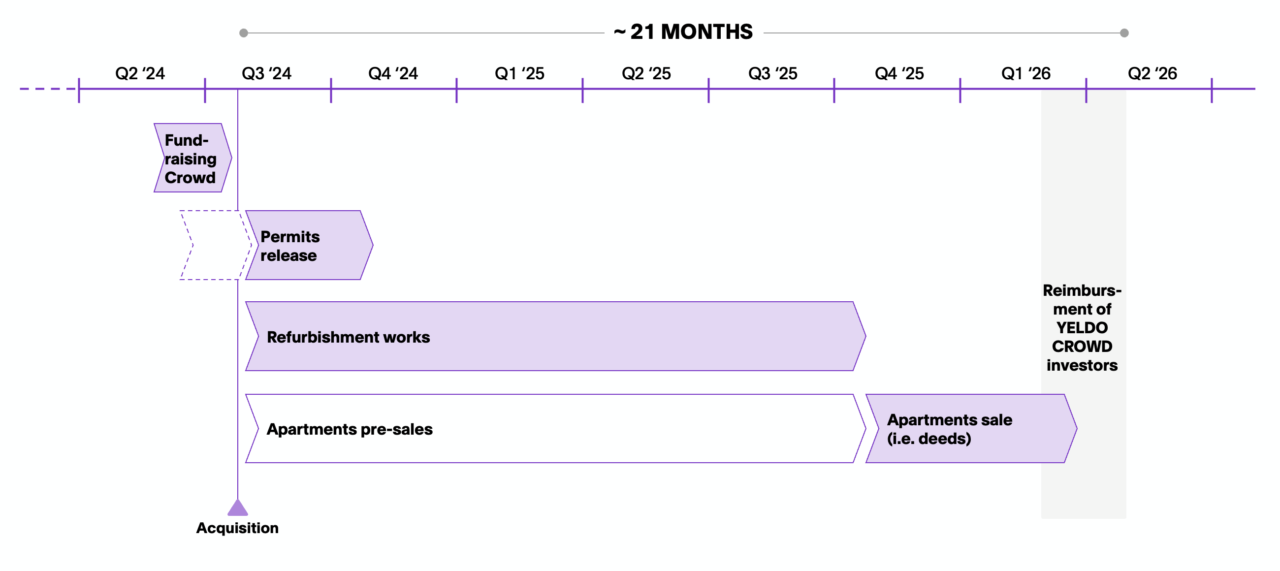

- 21 months: Expected duration

- Works scheduled to start by the end of Q3 ‘24 with completion expected by Q1 ‘26

The returns indicated are intended as expected returns, gross of the tax on the distribution during the redemption phase and the one-off investment fee:

- 1.5% for tickets under 25.000€

- 1.0% for tickets greater than or equal to 25.000€

Executive summary

The project involves the sale of 4 residential and 1 commercial units spread over 3 floors and 4 including garages and parking spaces. The total commercial area is 754 square meters.

The project includes the renovation of the residential units, as well as the renovation of the facades. On the ground floor, the commercial destination will be maintained and will be sold to an already identified investor.

For the renovation of the upper floor and the mansard, it is sufficient to submit a SCIA which will allow the renovation works to begin simultaneously.

For the refurbishment of the facades, authorization from the Landscape Commission will be required, with an expected approval time of approximately 90 days.

The project includes the renovation of the residential units, as well as the renovation of the facades. On the ground floor, the commercial destination will be maintained and will be sold to an already identified investor.

For the renovation of the upper floor and the mansard, it is sufficient to submit a SCIA which will allow the renovation works to begin simultaneously.

For the refurbishment of the facades, authorization from the Landscape Commission will be required, with an expected approval time of approximately 90 days.

Investment highlights

- 13.5% expected IRR

- Senior position: proceeds from sales will repay YELDO investors first

- First put option in favour of investors with the obligation from the Sponsor to repurchase their shares in the 9° month if the building permit for the facade renovation has not been obtained

- Second put option at 24° month if the full repayment of capital and return to investors has not yet occurred

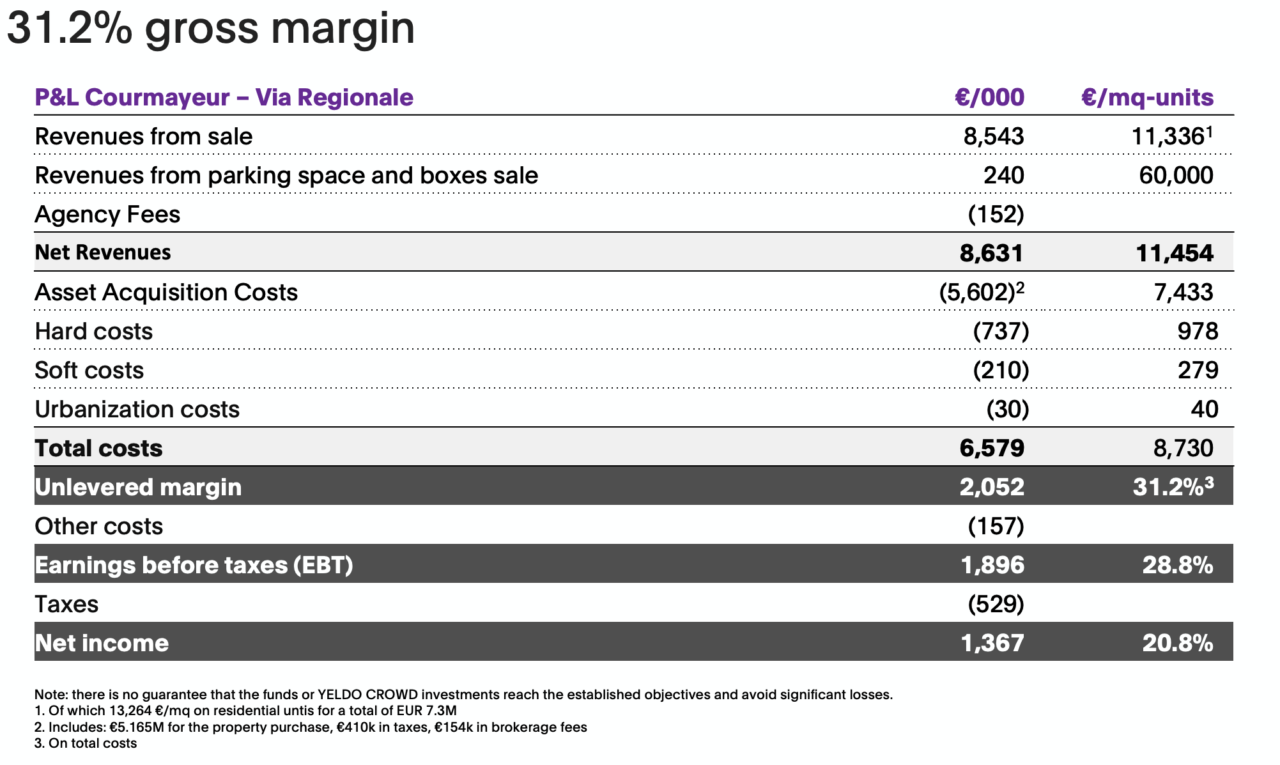

- 31.2% unlevered margin (on total costs) providing more security to investors

- 49% of break-even-point of investors capital

- Sponsor with proven experience in real estate redevelopment projects and over 15 years of experience in Milan and prime vacation home locations

- Tourist reference location, positioned close to the centre and near the to the ski lift

- The renovation involves the use of natural and eco-friendly materials characterized by a reduced environmental impact

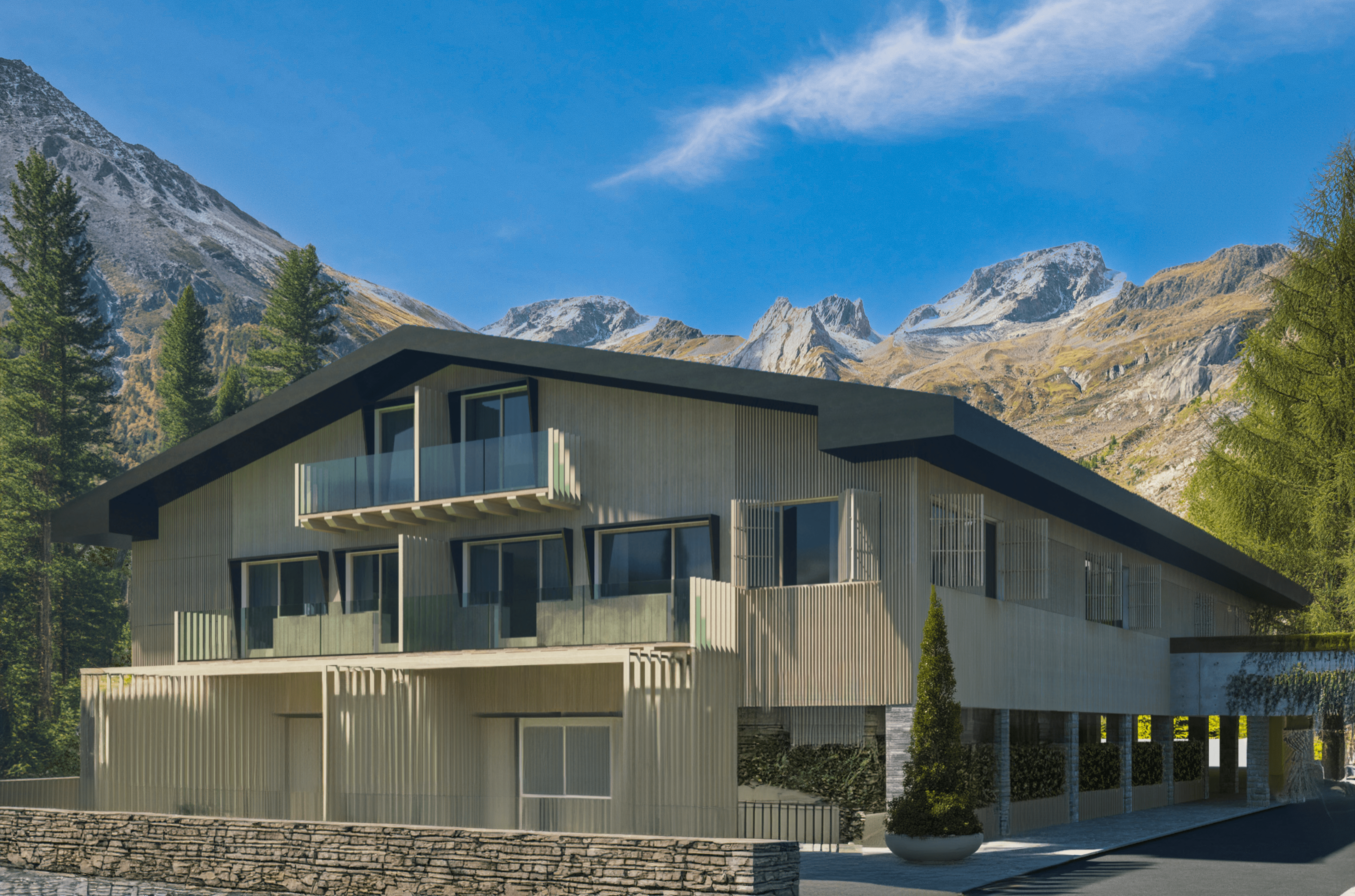

The asset

The operation involves the purchase and renovation of a building which will consist of 4 apartments, 1 commercial unit and 4 among car boxes and parking spaces.

The units, in the highest energy efficiency class, will feature modern finishes, home automation, and underfloor heating.

The renovation, following an ESG approach, involves the use of natural and eco-friendly materials characterized by reduced environmental impact.

The units, in the highest energy efficiency class, will feature modern finishes, home automation, and underfloor heating.

The renovation, following an ESG approach, involves the use of natural and eco-friendly materials characterized by reduced environmental impact.

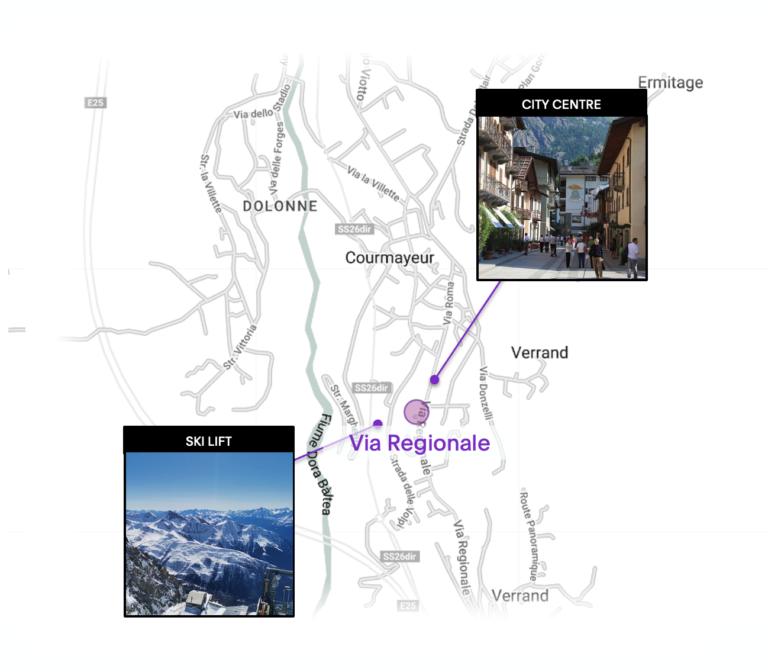

The location

The building undergoing intervention is located in a highly sought-after urban area, given Courmayeur's reputation as a tourist destination, both in the winter and summer seasons.

Courmayeur is highly desired as a location for purchasing a second home by both Italians and international buyers. Its appeal stems from its renowned status as a premier tourist destination, offering year-round attractions.

The strategic location of the property allows to reach the city centre in just 1 minute on foot and the Plan Chécrouit ski lift in 4 minutes only.

Courmayeur is highly desired as a location for purchasing a second home by both Italians and international buyers. Its appeal stems from its renowned status as a premier tourist destination, offering year-round attractions.

The strategic location of the property allows to reach the city centre in just 1 minute on foot and the Plan Chécrouit ski lift in 4 minutes only.

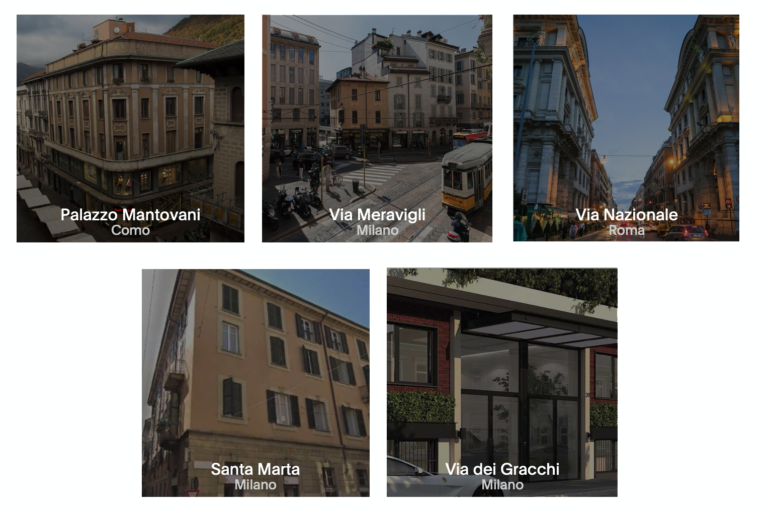

The sponsor

The initiative is promoted by Recupera Valore, an Italian developer with extensive experience in refurbishment projects

As of today:more than 15 years of experience

more than 8 active projects

€100M+ projects already closed

As of today:

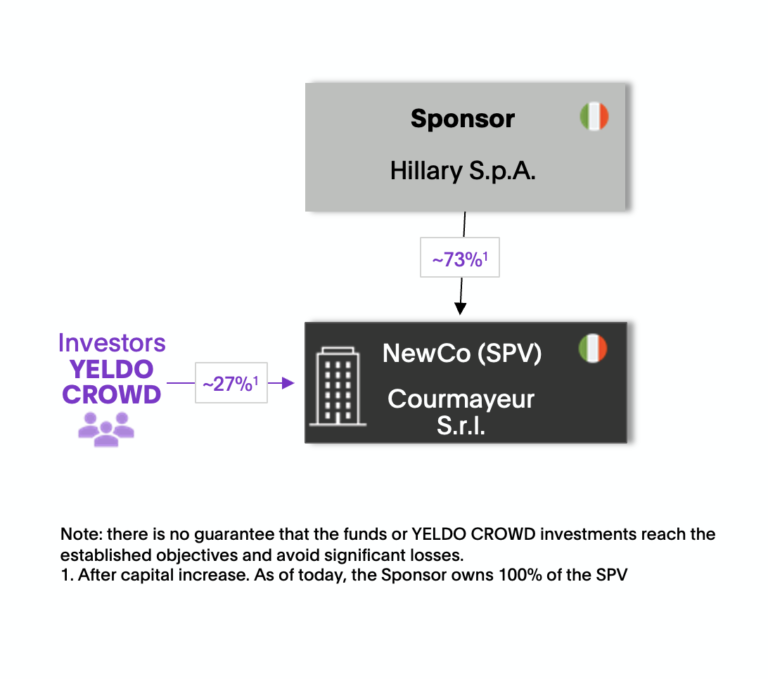

Deal structure

YELDO CROWD investors joining NewCo Courmayeur S.r.l. through a capital increase with preferred position.

YELDO investors joining capital increase of Courmayeur S.r.l., SPV set-up by the Sponsor for this project

YELDO investors joining capital increase of Courmayeur S.r.l., SPV set-up by the Sponsor for this project

Class A : Sponsor ordinary shares, with full administrative rightsClass B : YELDO Investors, 13.5% IRR, with a 1.08x minimum cash on cash in case of early reimbursement, with no administrative rights over ordinary management

Liquidation preference: YELDO investors’ capital and return benefit from a liquidation preference vs Sponsor equityPut-option: YELDO investors have the option to sell their shares to the Sponsor at the 9° month if the building permit for the façade renovation has not been issued and at the 24° month if both capital and returns have not yet been reimbursedEquity commitment agreement: the Sponsor will ensure the financial sustainability of the project by injecting additional equity if necessary, covering any cash shortfallsSelf-liquidating shares: when YELDO investors have received profits and/or reserves sufficient to cover their entire due amount, their shares shall automatically extinguish

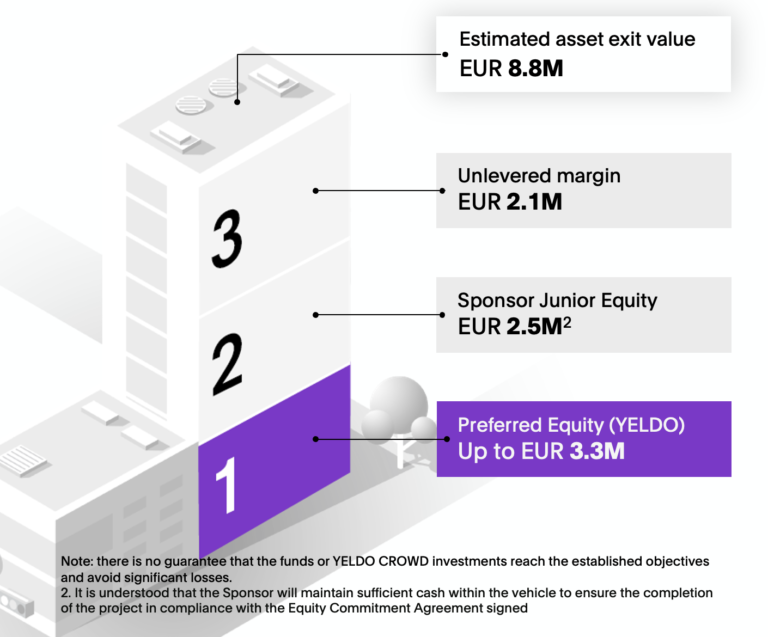

Waterfall of Payments

The order of payments will provide:

The break-even point, which is the percentage of sales revenue vs. business plan to be made to repay YELDO CROWD investors' capital is 49%.

- YELDO CROWD investors' capital (preferred equity)

- Expected return of YELDO CROWD investors

- Junior equity and sponsor's margin

The break-even point, which is the percentage of sales revenue vs. business plan to be made to repay YELDO CROWD investors' capital is 49%.

Timeline

P&L

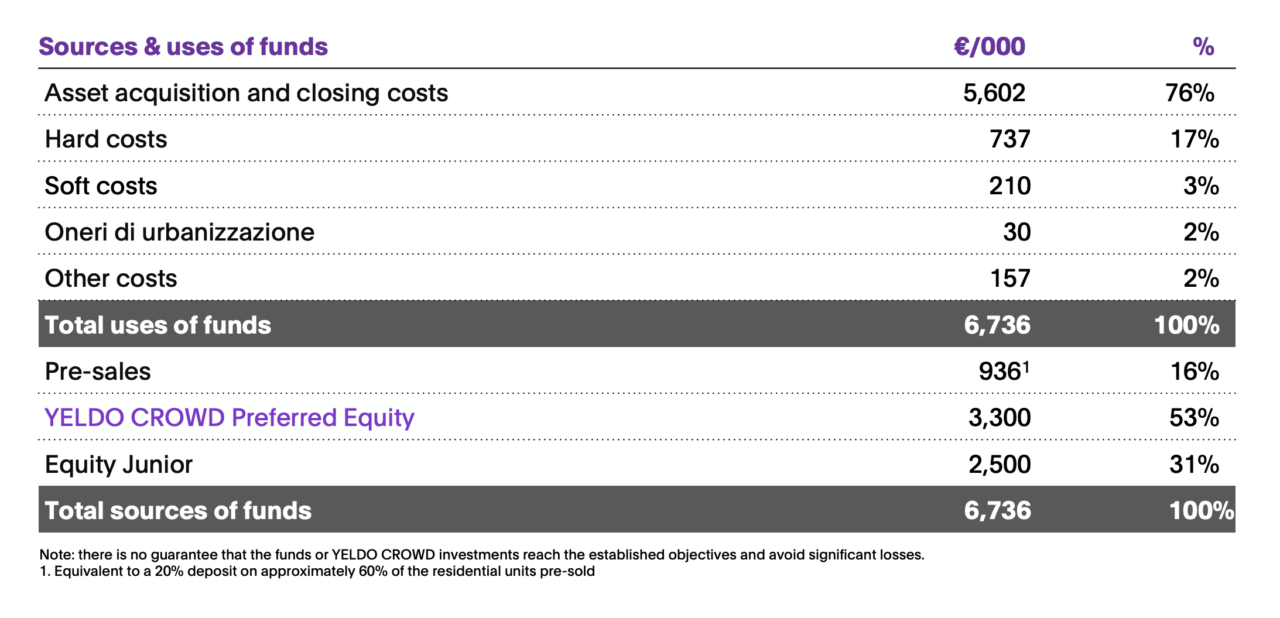

Sources and Uses

The Relevant Persons of Y-Crowd S.r.l., as defined in the Policy on the Management of Conflicts of Interest found on the website at the following link, may invest in the Offer under the same conditions as other investors, without benefiting from preferential treatment or privileged access to information, within the limits provided by the same policy

Italian

Italian English

English