Zoagli, Via Aurelia

The Zoagli, Via Aurelia project represents an investment opportunity in the development of a high-end residential complex, with a total commercial area of over 2,100 sqm.

Located in Zoagli, one of the most sought-after locations for the luxury market of the Ligurian Riviera, the project involves the redevelopment of a former hotel into an upscale residential complex comprising 16 units, with a private park, dedicated amenities, and an outdoor swimming pool, in a panoramic location with sea views and easy access to the town center and the coastline.

Investor funds will be used to finance part of the development costs. The key investment highlights are the following:

- 13% expected IRR (annual compounded rate)

- 44.3% expected total ROI

- Estimated duration: 36 months

The returns indicated represent expected gross returns, before taxes applied upon distribution at repayment and before the one-off investment fee.

Investment fee:

- 1.0% for tickets equal to or above EUR 100,000

Executive summary

The complex will consist of 16 residential units, with 16 parking spaces, 23 motorcycle spaces, and 16 storage rooms. It is set within a property that includes approximately 4,000 sqm of private park, where exclusive amenities for residents will be created, including an outdoor swimming pool.

The property is located in a panoramic area with easy access to the sea and the town center, offering picturesque sea views.

Investment highlights

- 13% annual compounded return and a minimum cash-on-cash yield of 10%

- 40.4% investor capital break-even point

- Irrevocable mandate to sell the asset in case of non-repayment within 36 months

- A prime tourist destination and home to second residences in the heart of the Ligurian Riviera

- Micro-location just 200 meters from the sea, with pedestrian access directly from the town’s central square

- Building permit ready for collection upon payment of the related fees

- Preliminary bank approval already obtained

- Asset with structures already completed and construction works ready to commence

The asset

The project envisages the development of a residential complex with over 2,100 sqm of commercial area. The property also includes approximately 4,000 sqm of private park, where dedicated amenities for residents will be developed, including an outdoor swimming pool.

The location

Located between Rapallo and Chiavari on the eastern Ligurian Riviera, just 200 meters from the sea, with direct pedestrian access from the village’s main square.

An area historically oriented toward high-end residential tourism, with strong appeal among Milanese, Lombard, and international buyers seeking waterfront properties along the Ligurian Riviera.

The Sponsor

It has a solid track record in the management and development of real estate projects, with a particular focus on the residential asset class:

- 20+ fully managed residential development projects

- 1,500+ residential units delivered

- 60+ residential construction sites managed

- 20+ logistics and industrial construction sites

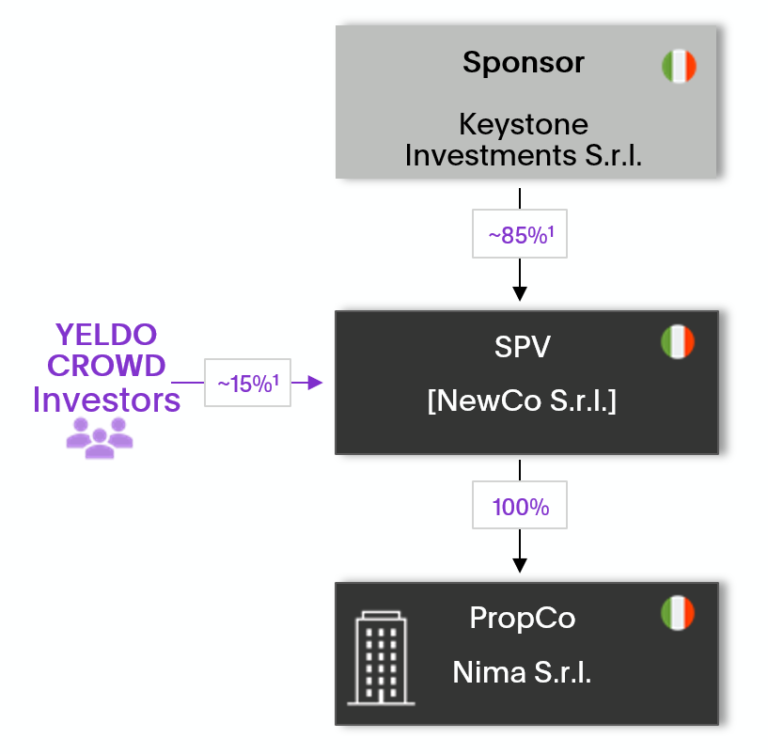

Deal structure

At the level of NewCo S.r.l., two classes of shares are planned:

Class A : ordinary shares held by the Sponsor, with full administrative rightsClass B : YELDO investors, 13% IRR, with a 1.10x minimum cash on cash in case of early reimbursement, with no administrative rights over ordinary management

Liquidation Preference : YELDO investors’ capital and returns benefit from a liquidation preference over the Sponsor’s equityMandate to Sell : irrevocable power of attorney to sell the asset if the Sponsor fails to repay investors within the 36th monthsEquity Commitment Agreement : the Sponsor ensures the project’s financial sustainability by committing additional own funds to cover any potential cash shortfallsSelf-Liquidating Shares : once YELDO investors have received profit distributions and/or reserves equal to their invested capital plus accrued returns, their shares will automatically be redeemed

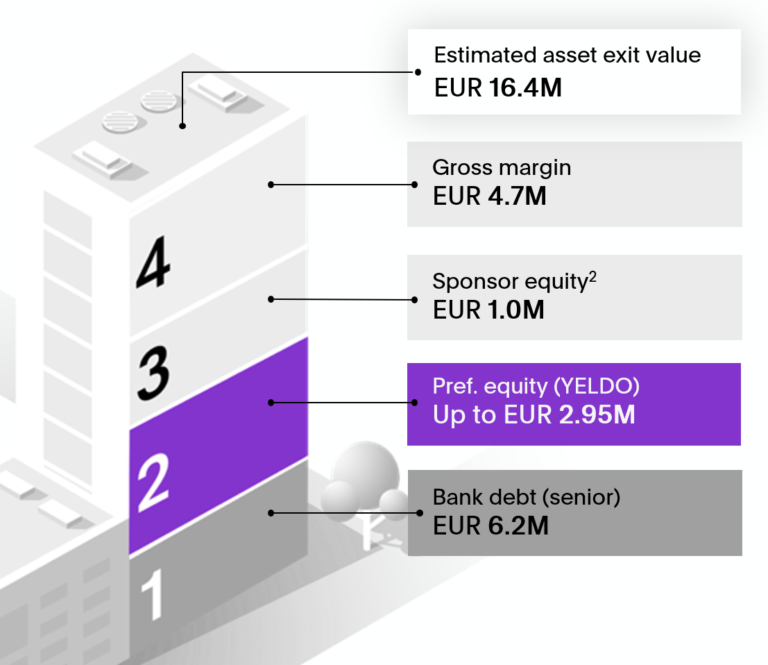

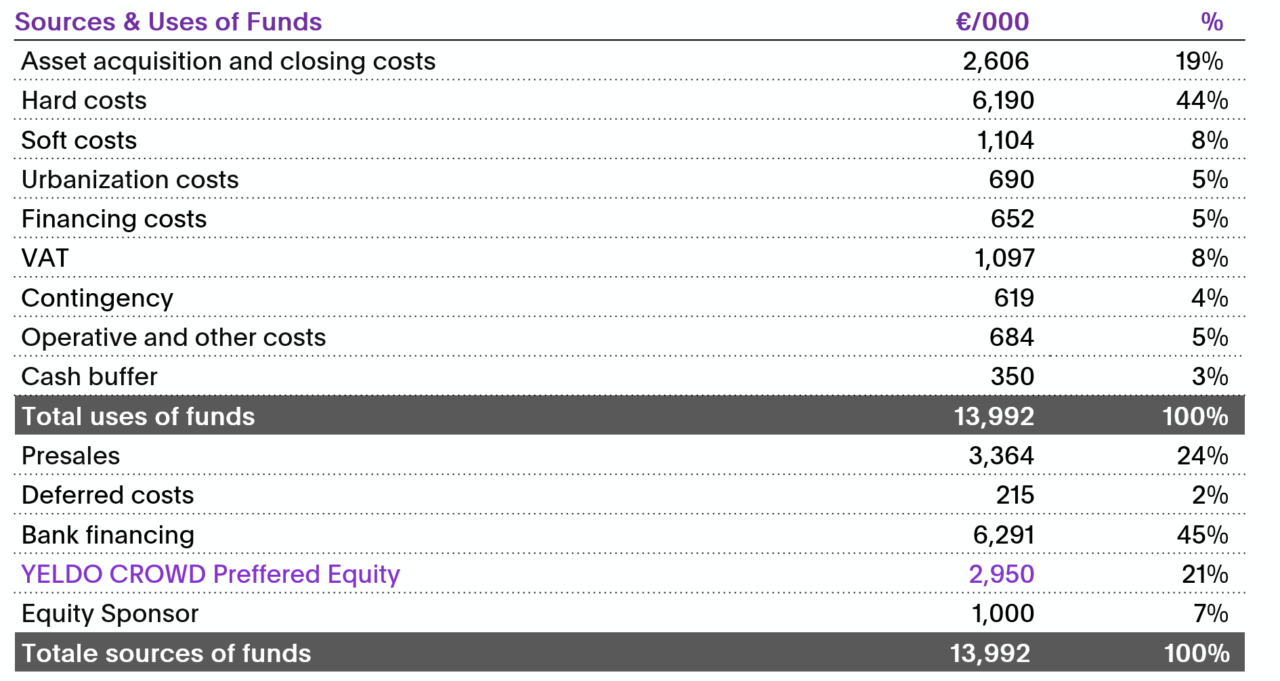

Capital structure

- 13% IRR (annual compounded return) with a liquidation preference over the Sponsor equity

- 78% Capital break-even point: level of sales versus the Business Plan at which YELDO Crowd investors reach capital break-even

- EUR 1.0M Sponsor equity committed to the project

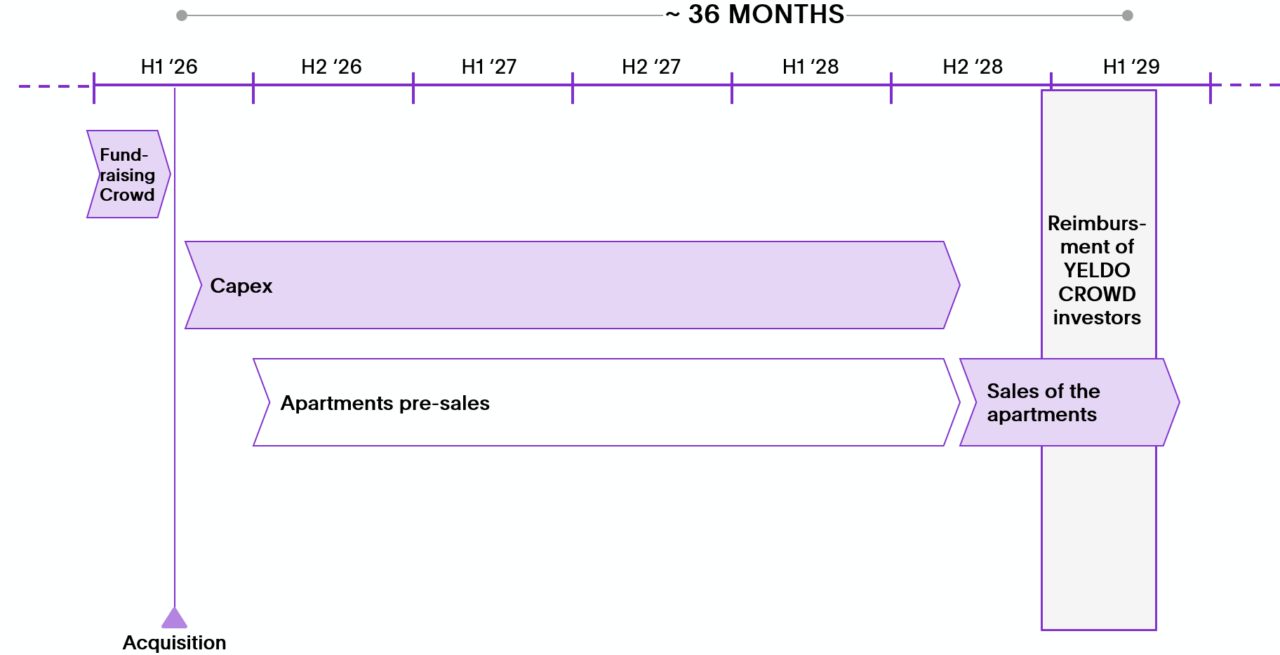

Timeline

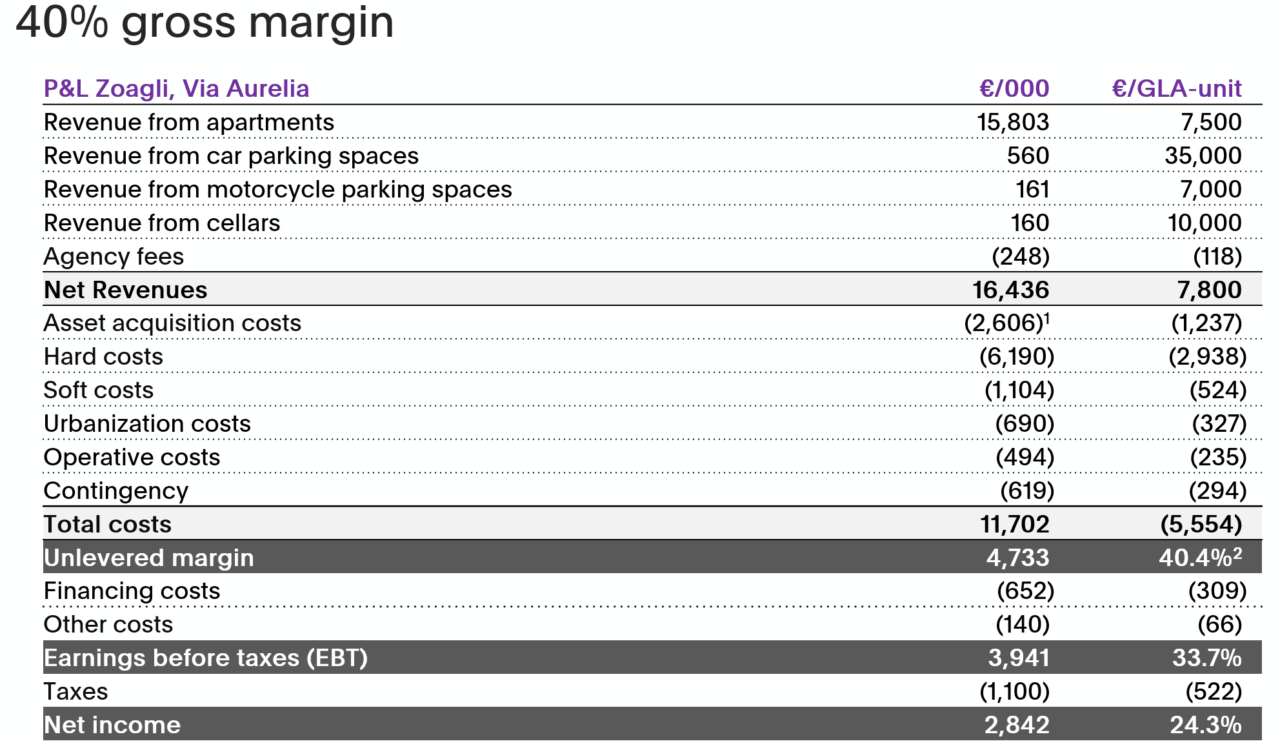

P&L

Sources and Uses

Italian

Italian English

English