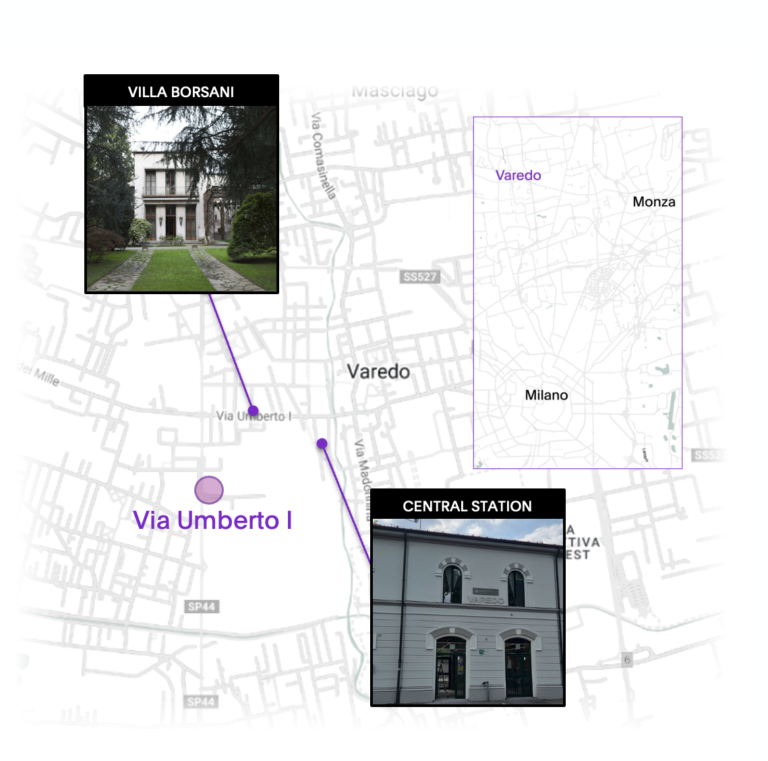

Varedo, Via Umberto I

Varedo, via Umberto I is an investment opportunity in a residential development project in the province of Monza Brianza.

Located in an area that is currently being requalified and developed, the project includes the construction of 3 residential buildings, within an area of 9,656 sqm, for a total of 88 residential units and 152 parking garages.

Investor funds will be used to finance acquisition and restructuring costs (CAPEX). The main characteristics of the project are the following:

- 52.1% expected ROI

- 15% IRR (compound annual rate)

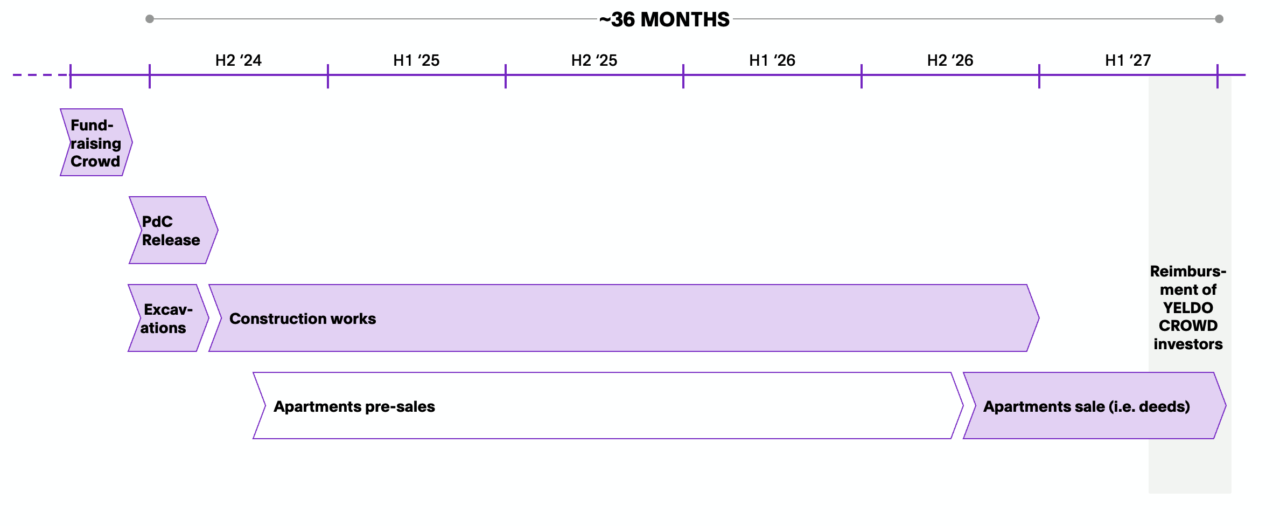

- 36 months expected duration

- Excavation will start in June, with construction starting by September and expected to end by Q4 2026

The returns indicated are intended as expected returns, gross of taxation on the distribution during redemption and the one-off investment fee:

- 1.5% for tickets under €25,000

- 1.0% for tickets greater than or equal to €25,000.

Executive summary

The initiative includes the development of a residential complex of 9,656 sqm of commercial area. It entails constructing 3 residential buildings for a total of 88 residential units and 152 parking garages in Via Umberto I, Varedo, in the province of Monza Brianza.

The building permit is a “PdC convenzionato“ (Permit to Build), which will be issued within 45 working days after being deposited by the end of June.

The building permit is a “PdC convenzionato“ (Permit to Build), which will be issued within 45 working days after being deposited by the end of June.

Points of strength

- 15% IRR (compound annual rate)

- Strong security package for YELDO CROWD investors, including a put option in favor of investors with the obligation of the Sponsor to repurchase their shares after 9 months (if the building permit has not been issued and bank financing has not been approved) and after 36 months (if capital and return repayment has not occurred)

- 45% unlevered margin (on total costs) providing more security to investors

- Break-even-Point to repay investors’ capital at 1,954€/sqm (-39% vs BP)

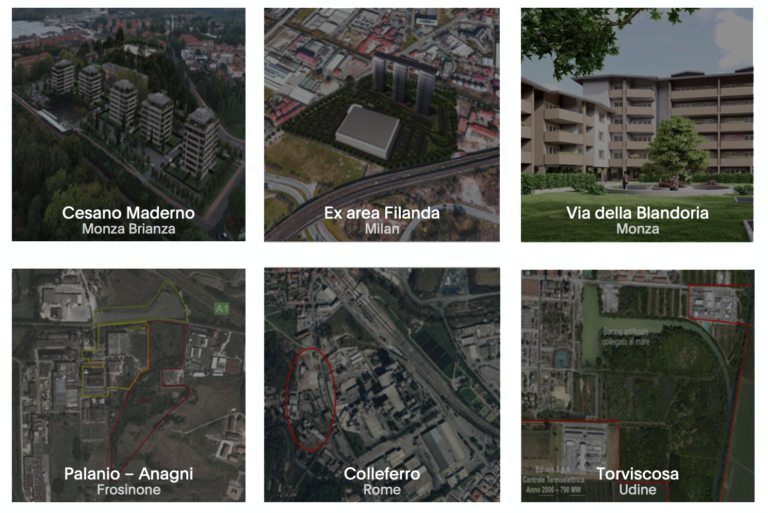

- Sponsor with proven experience in real estate development and to whom YELDO has already financed 2 operations (i.e., Varedo logistics, Monza Blandoria)

- “PdC convenzionato“ (Permit to Build), significantly reducing administrative risk and related approval timelines (i.e., 45 working days from submission)

- Varedo is located approximately 15km north of Milan and 10km from Monza, allowing easy access to the center of Milan in just 20’ by train

- The project is part of a larger urban redevelopment plan that includes the development of new commercial areas and the introduction of new services

- The units will be marketed by AbitareCo, leading brokerage firm in the Milan area

L'asset

The operation involves the development of a residential complex consisting of 88 apartments and villas and 152 parking spaces, divided across a total of 3 buildings immersed in greenery. The architectural design is modern and prioritizes maximum energy efficiency.

The project entails the creation of various types of apartments: one-bedroom, two-bedroom, and three-bedroom apartments, as well as penthouse villas.

The units, in A4 energy class, will feature modern finishes, while the buildings will be distinguished by a sober and elegant style, enriched by ample green spaces. Thanks to interventions supporting the local community and economy of Varedo, the project will have an important ESG dimension.

The units, in A4 energy class, will feature modern finishes, while the buildings will be distinguished by a sober and elegant style, enriched by ample green spaces. Thanks to interventions supporting the local community and economy of Varedo, the project will have an important ESG dimension.

The location

The residential market in Varedo is active and growing, both in terms of transactions and prices for sales and rentals. In 2022, there was a confirmed upward trend in prices compared to previous years, with a +28% increase in residential transactions.

The asset is well connected to Milan, being only 3’ away from the station, allowing access to Cadorna station in 20’. The entrance to the highway is just 5km away and allows reaching Milan in approximately 30'.

The operation is part of a larger ongoing redevelopment project, which includes, among other things, the revision of the road network, the introduction of new shopping centers and services, a space dedicated to shops, and a significant logistic hub.

The asset is well connected to Milan, being only 3’ away from the station, allowing access to Cadorna station in 20’. The entrance to the highway is just 5km away and allows reaching Milan in approximately 30'.

The operation is part of a larger ongoing redevelopment project, which includes, among other things, the revision of the road network, the introduction of new shopping centers and services, a space dedicated to shops, and a significant logistic hub.

The sponsor

The development is promoted by Gruppo MG, an Italian developer with an extensive experience in urban regeneration projects.

As of today:more than 55 years of experience

more than 500.000 active projects (sqm)

2 Projects already financed: Varedo Ex Snia with YELDO for EUR 5M. Monza, via della Blandoria with YELDO CROWD for EUR 2.5M

As of today:

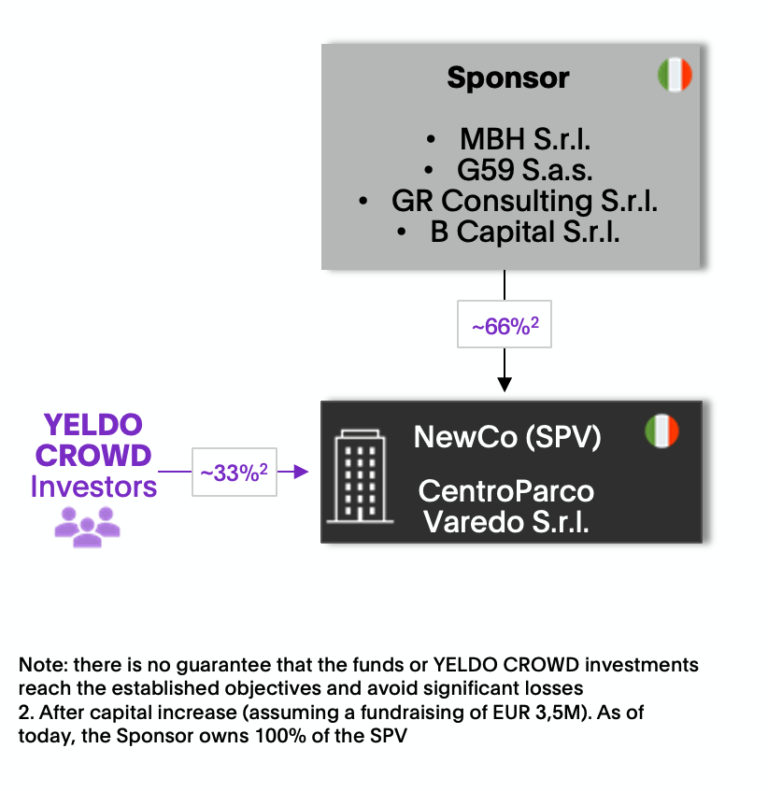

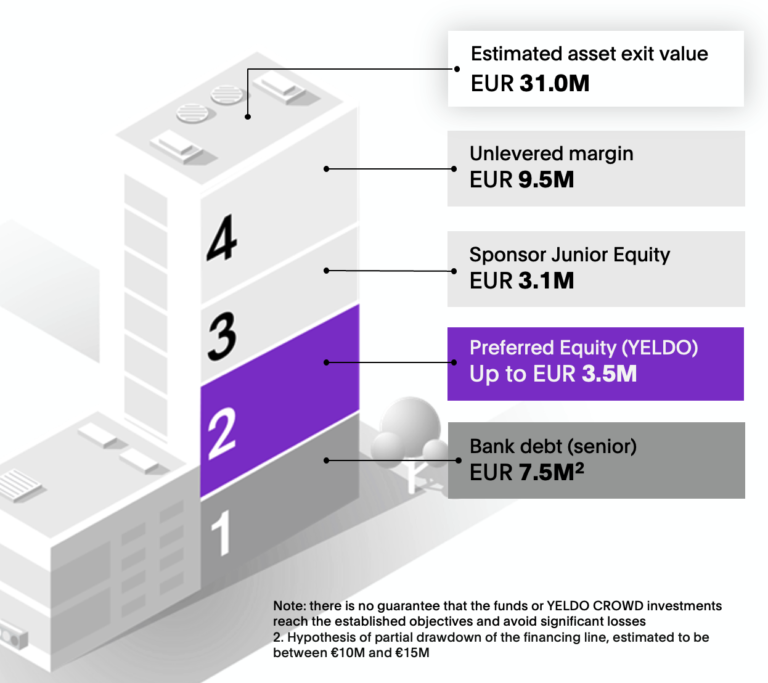

Deal structure

YELDO CROWD investors joining NewCo CentroParco Varedo S.r.l. through a capital increase with preferred position.

Class A : Sponsor ordinary shares, with full administrative rightsClass B : YELDO Investors, 15.0% IRR, with a 1.09x minimum cash on cash in case of early reimbursement, with no administrative rights over ordinary management

Liquidation preference : YELDO investors’ capital and return benefit from a liquidation preference vs Sponsor equityPut-option : YELDO investors have the option to sell their shares to the Sponsor, at the 9° month if the building permit has not been issued or bank financing has not been obtained or at 36° month if both capital and returns have not yet been reimbursedEquity commitment agreement : the Sponsor will ensure the financial sustainability of the project by injecting additional equity if necessary, covering any cash shortfallsSelf-liquidating shares: when YELDO investors have received profits and/or reserves sufficient to cover their entire due amount, their shares shall automatically extinguish

Waterfall of payments

YELDO preferred equity protected by EUR 13.0M (junior equity + gross margin).

After repayment of the bank debt, the order of payments will include:

Level of sales vs Business Plan at which YELDO CROWD investors reach break-even-point of invested capital is equal to 61%.

After repayment of the bank debt, the order of payments will include:

- YELDO CROWD Investor Capital (preferred equity)

- YELDO CROWD investors' expected return

- Junior equity and sponsor margin

Level of sales vs Business Plan at which YELDO CROWD investors reach break-even-point of invested capital is equal to 61%.

Timeline

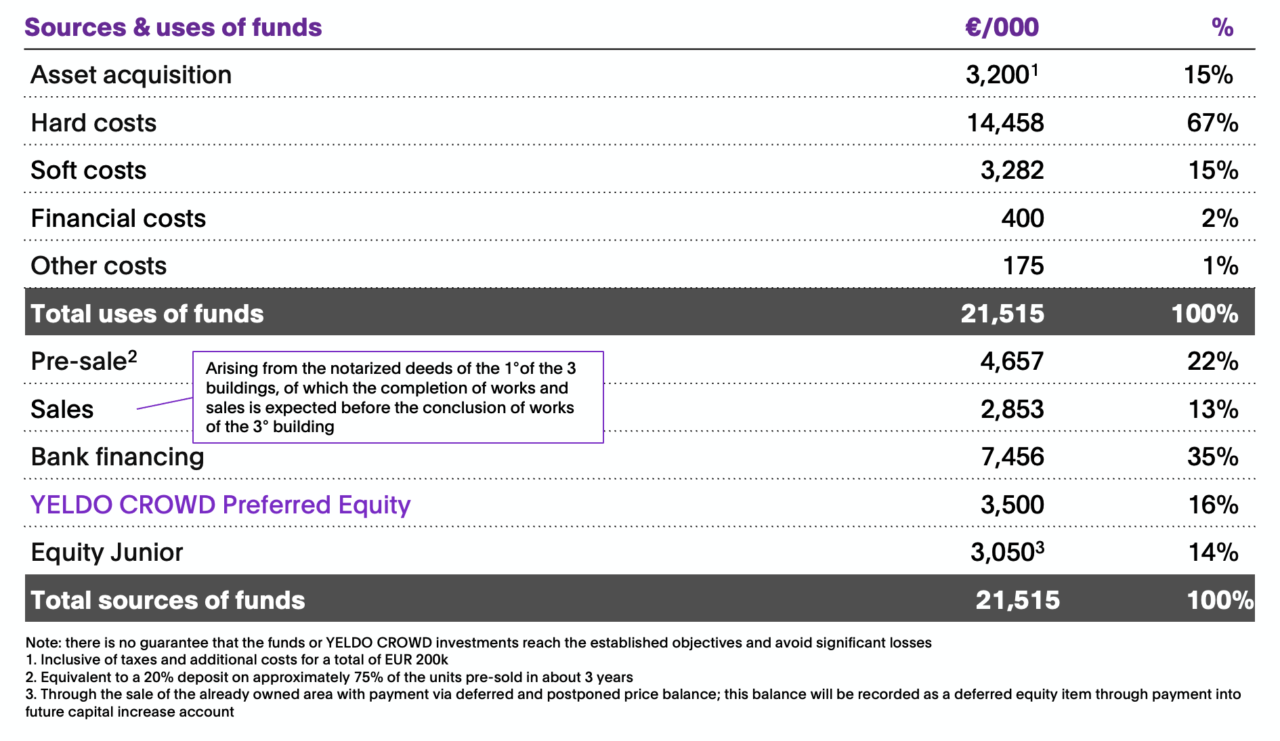

Sources & Uses

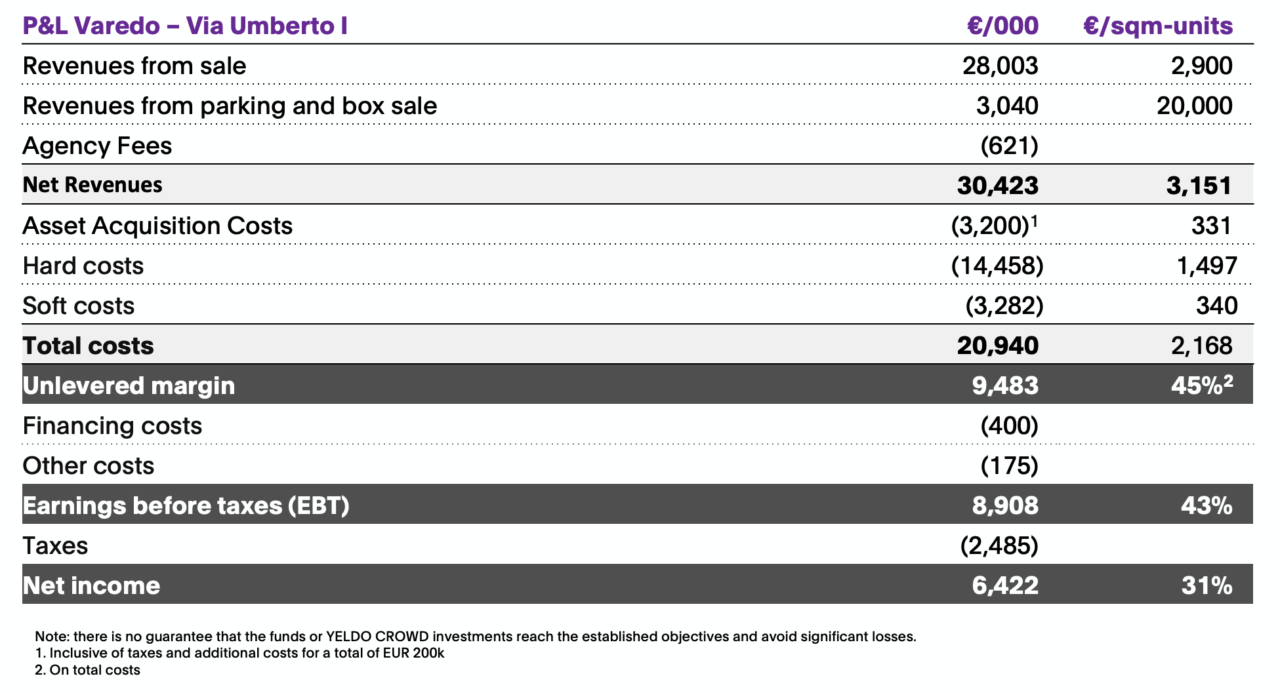

P&L

The Relevant Parties of Y-Crowd S.r.l., as defined in the Conflict of Interest Management Policy available on the website at the following link may invest in the Offering at the same terms as other investors, without receiving preferential treatment or privileged access to information, within the limits established by the same policy.

Italian

Italian English

English