Monza, via della Blandoria

Monza, via della Blandoria is an investment opportunity in a project for the acquisition and development of a 5,671 sqm residential complex, located near the Monza park, with significant greenery in the surrounding area. This is a Development of affordable housing at reduced selling prices in favour of various income brackets. The investors’ funds will be used to finance part of the acquisition and capex. The main characteristics of the project are as follows:

- 47% expected ROI

- 15.0% IRR (compound annual rate)

- 33 expected holding period

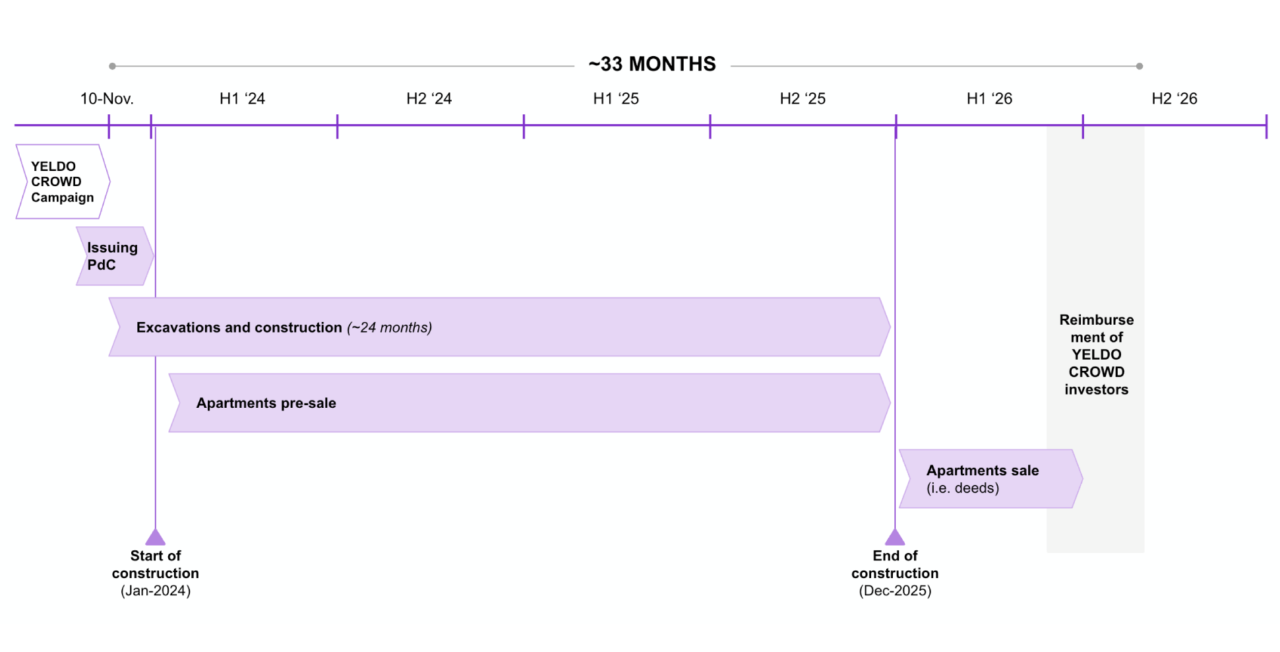

- Excavations start in November ‘23, construction works start by January ’24, completion expected by the end of ‘25

Returns shown are expected returns, gross of applicable final distribution tax and one-time investment fee:

- 1.5% for investments from €10,000 to €24,999

- 1% for investments equal to or greater than €25,000

The project

The project involves the construction and sale of a residential complex in Monza,

with a total of 55 residential units and 92 parking spaces. The operation, with a strong social vocation,

is part of the subsidised housing scheme, the objective of which is to make the purchase of a first

home accessible to more income brackets. The sale will therefore take place at subsidised prices,

contributing significantly to mitigating the commercial risk.

As in all our transactions, YELDO CROWD investors' return and capital benefit from preferential repayment over the Sponsor's capital and margin. In addition, thanks to the put-option, YELDO CROWD investors will have the opportunity to sell their units to the Sponsor if at the end of the 33rd month capital and yield have not yet been repaid.

As in all our transactions, YELDO CROWD investors' return and capital benefit from preferential repayment over the Sponsor's capital and margin. In addition, thanks to the put-option, YELDO CROWD investors will have the opportunity to sell their units to the Sponsor if at the end of the 33rd month capital and yield have not yet been repaid.

Point of strength

The operation has several strengths:

Attractive risk-return profile: This investment opportunity offers an attractive return with an internal rate of return (IRR) of 15%, despite the risk profile associated with the transaction. The break-even point of the investors' capital is reached at €1,868/sqm, which represents a significant 35% discount from the original business plan. To provide further security for YELDO CROWD's investors, a strong package of guarantees is in place, including a put option that allows investors to sell their shares after 33 months, with a commitment from the Sponsor to buy them back.ESG-driven development with limited marketing risk: This project promotes affordable housing development, which makes it accessible to different income brackets. The sales prices of the units are capped at € 2,600/sqm, approximately 20% lower than the market average. This pricing strategy significantly reduces the risk and speeds up the time to market. The marketing of the units will be handled by Abitare Co., a leading player in the market, guaranteeing professional management and effective sales strategies.High demand location with increasing prices: The location of the project is extremely advantageous as it is characterised by a strong demand for residential units, with prices increasing by 13.8% since 2020 (Source: Il Sole 24 Ore, Real Estate, January 2023). The proximity to the park of Monza, with large green spaces nearby, makes it particularly attractive for those looking for housing in a residential but well-connected area. This combination of factors provides a solid basis for investment success.

The asset

This project involves the development of two buildings with a total area of 5,671 square metres, which will house a total of 55 residential units. These units vary in size, offering living solutions ranging from 45 to 140 square metres.

Although the units will be delivered unfurnished, they will feature modern finishes and contemporary design, and will be equipped with flooring, sanitary ware, lighting and air-conditioning systems.

All this will contribute to creating attractive and comfortable residential environments for future buyers. It should be noted that this residential property will have an extraordinary location in front of the Parco di Monza, one of the largest and most renowned parks in Europe, which includes the famous Formula 1 racetrack and the historic Villa Reale.

All this will contribute to creating attractive and comfortable residential environments for future buyers. It should be noted that this residential property will have an extraordinary location in front of the Parco di Monza, one of the largest and most renowned parks in Europe, which includes the famous Formula 1 racetrack and the historic Villa Reale.

The location

The property's location is in a semi-central area of Monza guaranteeing access to the city's services, with the added advantage of being just a few minutes' walk from the prestigious Villa Reale and its beautiful park.

With the rise in real estate prices in Milan, demand for residential units in Monza has grown rapidly, recording a 13.8% price increase from 2020 to date (Source: Il Sole 24 Ore, Real Estate, January 2023). Monza is an ideal choice for young couples, families and professionals working in Milan. The city offers a green environment and enjoys excellent connections to the centre of Milan, which can be reached in just 10 minutes by train or 25 minutes by car.

With the rise in real estate prices in Milan, demand for residential units in Monza has grown rapidly, recording a 13.8% price increase from 2020 to date (Source: Il Sole 24 Ore, Real Estate, January 2023). Monza is an ideal choice for young couples, families and professionals working in Milan. The city offers a green environment and enjoys excellent connections to the centre of Milan, which can be reached in just 10 minutes by train or 25 minutes by car.

Lo sponsor

This project is promoted by Gruppo MG, a renowned Italian developer with extensive experience in urban regeneration and property development projects. The MG Group boasts a prestigious track record:

+ 55 years of experience in the sectormore than 500,000 sqm of active projects1 project financed with the YELDO Group, totalling 5 million euro, demonstrating their expertise and solidity in the sector

Deal structure

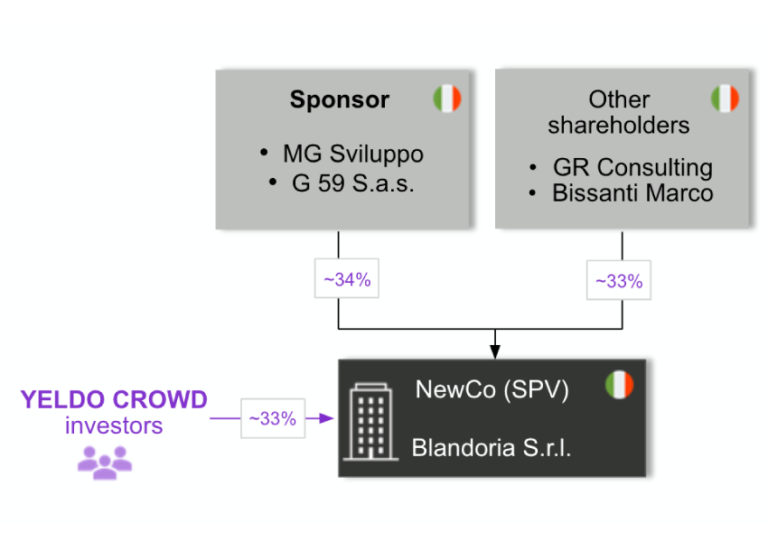

The investors of YELDO CROWD join the capital increase of NewCo Blandoria S.r.l. through a capital increase (preferred equity). Within Blandoria S.r.l., there are two classes of shares:

Il pacchetto di garanzie è solido e mira a proteggere gli investitori YELDO:

Class B : quote ordinarie dello Sponsor, con pieni diritti amministrativiClass B : quote investitori YELDO, 15,0% IRR antergato, con un 1,11x di minimo cash on cash in caso di rimborso anticipato, senza diritti amministrativi sulla gestione ordinaria

Il pacchetto di garanzie è solido e mira a proteggere gli investitori YELDO:

Liquidation preference : YELDO investors’ capital and return benefit from a liquidation preference vs Sponsor equity.Put-option : YELDO investors have the option to sell their shares to the Sponsor if, at the end of 33° month, both capital and returns have not yet been reimbursed.Equity commitment agreement : the Sponsor will ensure the financial sustainability of the project by injecting additional equity if necessary, covering any cash shortfalls.Self-liquidating shares : when YELDO investors have received profits and/or reserves sufficient to cover their entire due amount, their shares shall automatically extinguish.Escrow account : capital raised from YELDO investors will be transferred into a notarial escrow account to safeguard the finalization of the asset purchase process.

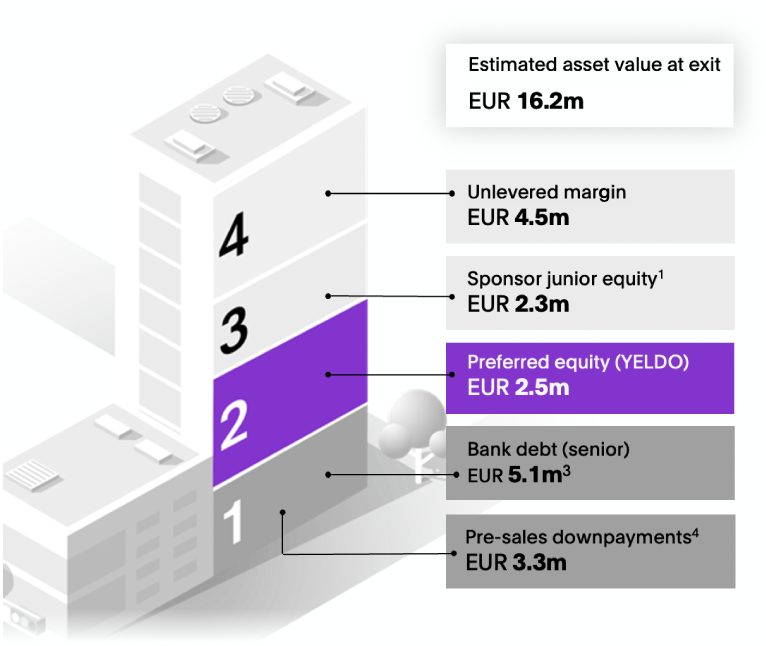

Waterfall of payments

In the waterfall of payments, YELDO CROWD's investors enjoy a preferential position, both on invested capital and expected return, protected by 6.8M€ (equity Sponsor + gross margin)

After the repayment of the bank debt, the order of payments will include:

The break-even point, i.e. the percentage of sales proceeds vs. business plan to be made to repay YELDO CROWD investors' capital is 65%, equivalent to a sale price of €1,868/sqm (-35% vs BP)

After the repayment of the bank debt, the order of payments will include:

- YELDO CROWD investors' capital (equity preferred)

- Expected return of YELDO CROWD investors

- Junior equity and sponsor's margin

The break-even point, i.e. the percentage of sales proceeds vs. business plan to be made to repay YELDO CROWD investors' capital is 65%, equivalent to a sale price of €1,868/sqm (-35% vs BP)

Timeline

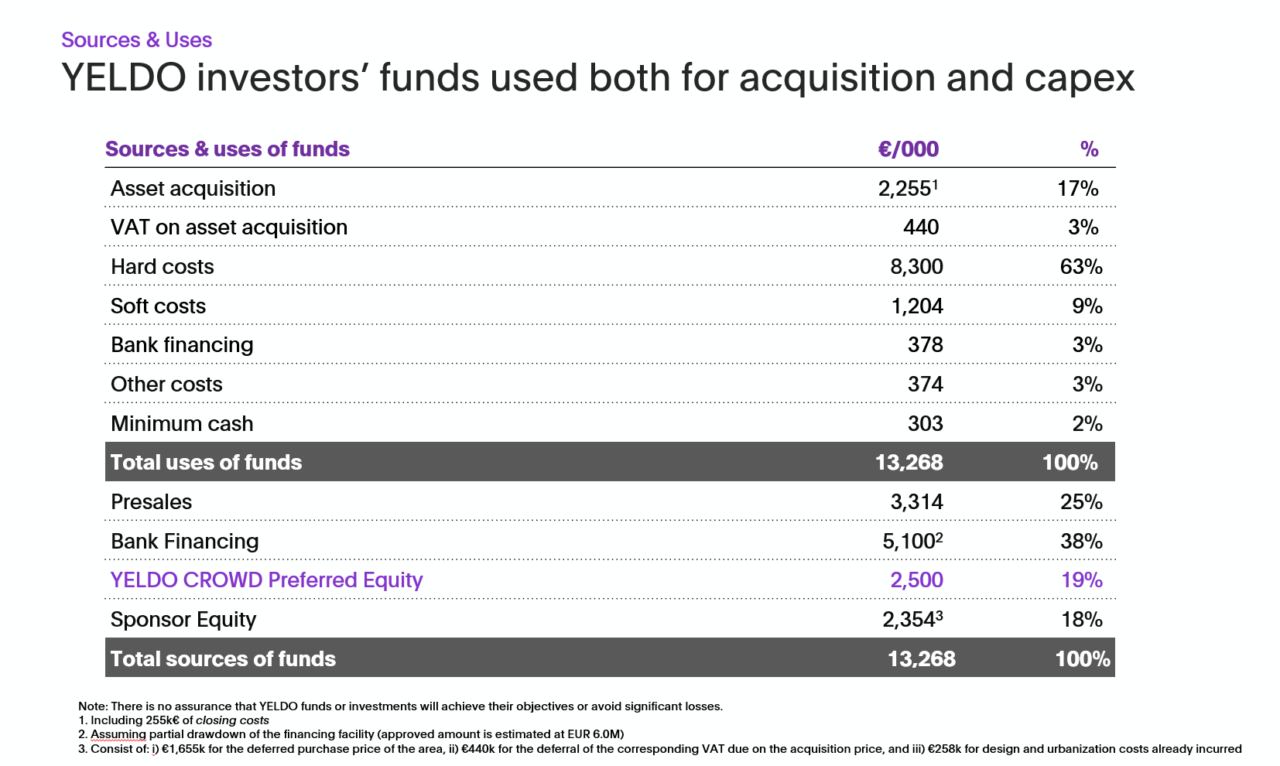

Sources and uses

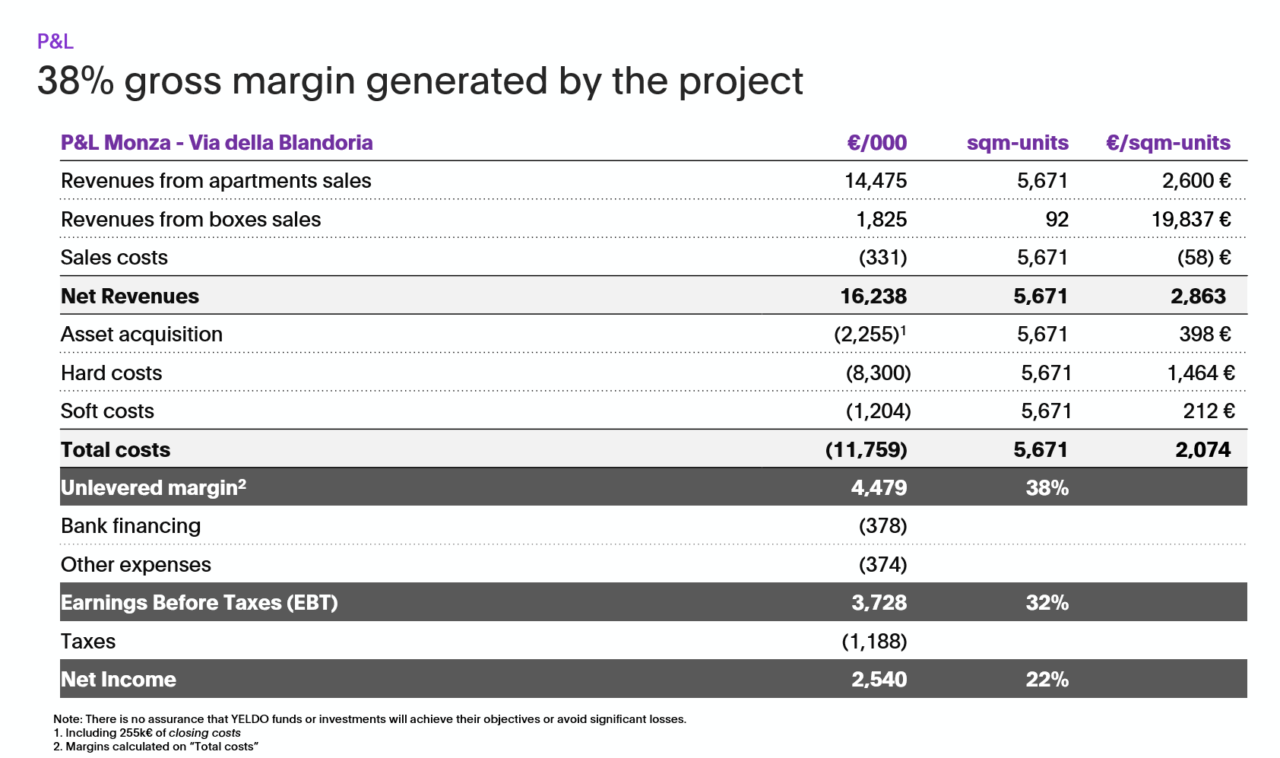

P&L

Italian

Italian English

English