Monza, Teodolinda :

the project

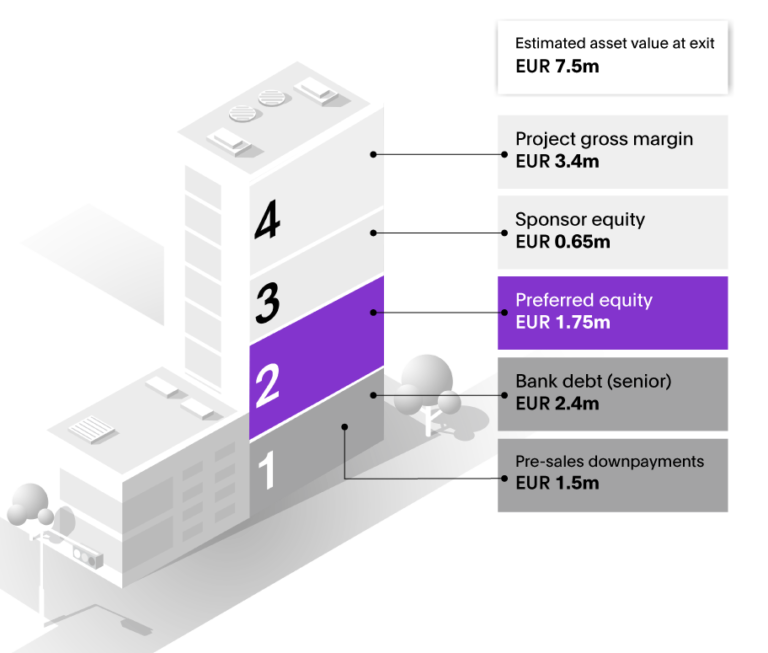

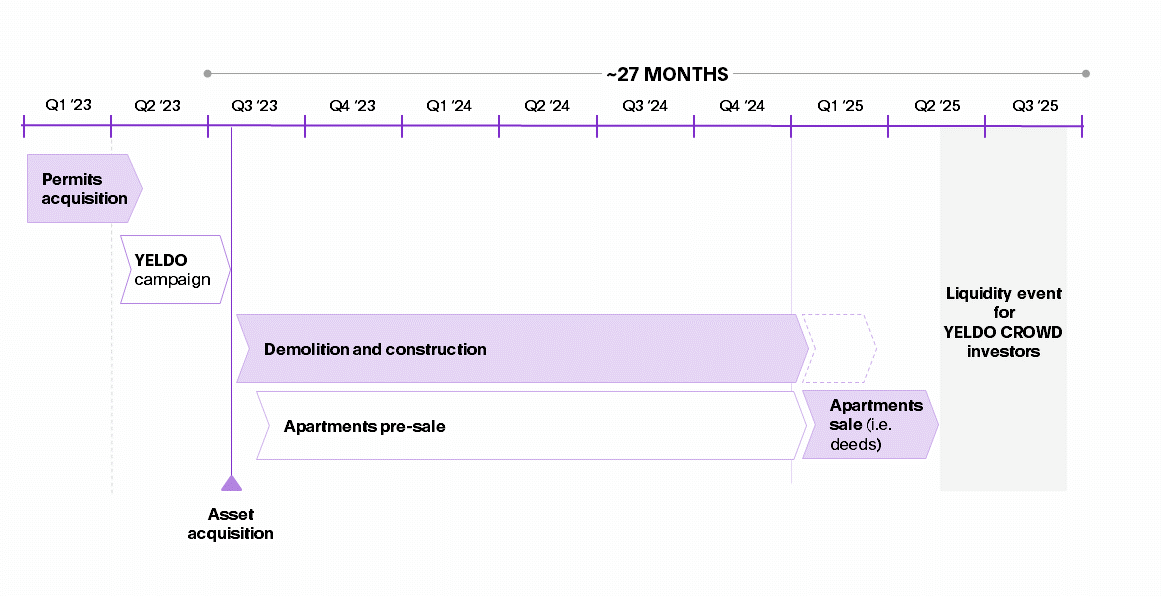

Monza, Teodolinda is an investment opportunity in a renovation project of two premium properties in two residential districts in the sought-after city of Monza. One is located near the center and the other near the park of Villa Reale, only ten minutes by train from Milan. The project involves the development and fractional sale of 18 residential units (and 19 parking spaces) of which 9 units are located in via Ampere and 9 units in via Ugolini. The funds, together with the Sponsor’s equity, will be used to finance the acquisition of the two properties and carry out the planned refurbishments. The expected holding period of the investment is approximately 27 months (until the third quarter of 2025), with an expected ROI of up to 45.5% and an IRR determined by a choice of two classes of shares:

- Class B: 17.0% IRR, for investments from €10,000 to €24,999

- Class C: 18.0% IRR, for investments equal to or greater than €25,000

Both the capital and the yield benefit from a liquidation priority over the junior equity of the Sponsor. Returns shown are expected returns, gross of applicable final distribution tax and one-time investment fee:

- 1.5% for investments from €10,000 to €24,999

- 1.0% for investments equal to or greater than €25,000

The project

via Ampère 9 , which involves the renovation of the building-

via Ugolini 20 , which involves the demolition and reconstruction of the building.

Strengths of the deal

- Attractive yield up to 18% IRR compared to the risk profile of the deal

- Break-even point of investors' capital reached at just €2,051/sqm, a sale value 44.2% lower than expected in the business plan

- The bank debt and the building permit have already been obtained for the via Ugolini asset, and are being obtained for the one in via Ampère

- The developments envisaged by the project, made up of 9 units each, are of limited size, thus limiting the risks associated with construction and marketing

- The project location benefits from robust demand and an upward trend in residential unit prices, which have increased by 13.8% since 2020

- The units are expected to sell at an average price of 3,764 €/sqm, which is in line with comparable market prices, as confirmed by independent external advisor K2Real

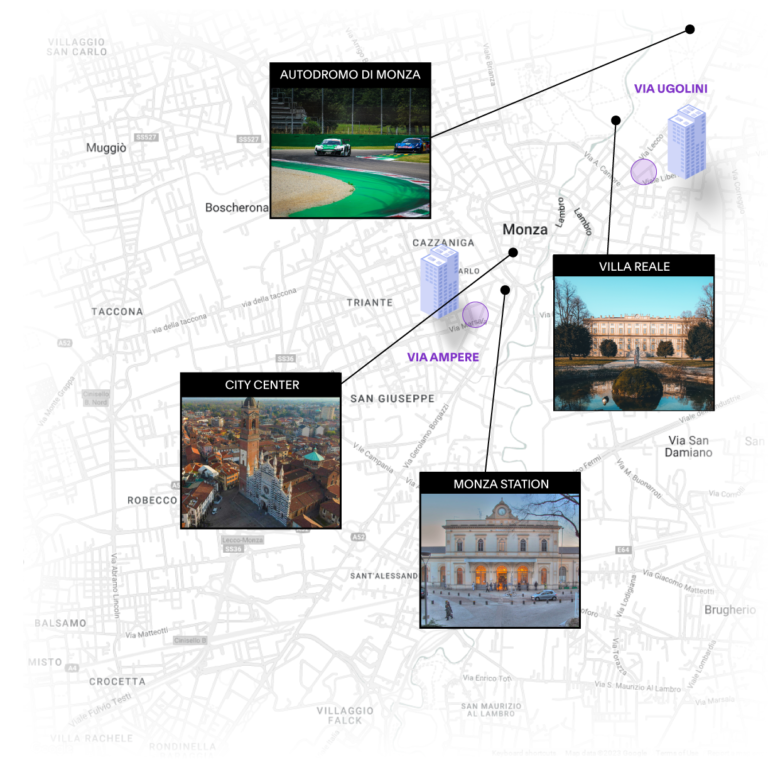

The location

The properties are located near the city center, with immediate access to the services and amenities offered. Furthermore, one of them is located a few minutes' walk from Villa Reale and its park, while the other is a short distance from the centre.

Monza is an ideal choice for young couples, families and young professionals working in Milan, offering an attractive alternative, especially considering the constantly rising prices in the Milan property market. The city offers a pleasant environment surrounded by greenery and has an excellent connection to the center of Milan, reachable in just 10 minutes by train or 20 minutes by car. Since 2020, the growing demand for properties in Monza has been stimulated by the increase in prices of residential units in the center of Milan.

The asset

Via Ampère : it is an Art Nouveau villa with high standard finishes, a terrace/garden for each apartment and a common fitness centre. The apartments in via Ampère vary in size, starting from 81 m2 to 140 m2, and the property has 9 outdoor parking spacesVia Ugolini: open spaces with large windows, fine finishes, private gardens for the ground floor apartments and large terraces for the other apartments. The apartments in via Ugolini 20 vary in size, starting from 58m2 up to 140m2, and the property has 10 parking spaces, 3 of which are internal.

The Sponsor

The sponsor of the transaction is Teodolinda Capital Investments S.p.A., an emerging Italian developer with a strong professional experience in residential developments in the Milan and Monza area.

The company was born from the partnership between four partners:

- HDE Holding company, real estate asset management company with strong positive track record

- Hangar Milano, whose founder, Paolo Del Barba, has over twenty years of experience in the consultancy and valuation of mainly residential assets

- Bianchini&Dieni Studio Legale, leading law firm, specialized in corporate crisis, contracts, governance and industrial law

- Venturato Benzoni Studio associati, well-known accounting firm, specialized in tax and corporate law

Overall, the track record of the shareholders of Teodolinda Capital Investments S.p.A. see:

About 15,000 m2 sold Approximately 52 million euros as the total amount of the market value of the real estate developments carried outMore than 15 million euros generated margin

Teodolinda Capital Investments S.p.A. stands out for its expertise in the sector and for the success achieved in the realization of high quality real estate projects.

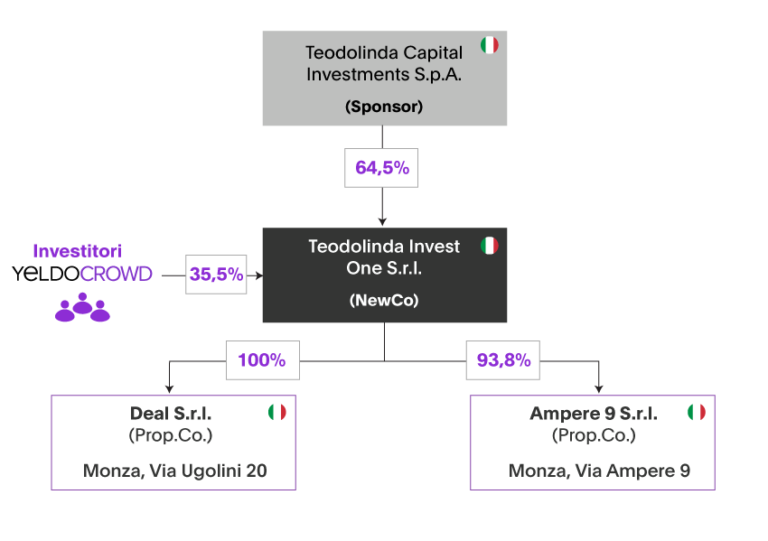

Deal structure

Class A: ordinary shares of the SponsorClass B: reserved for YELDO CROWD investors with an investment between €10,000 and €24,999, with an IRR of 17%.Class C: reserved for YELDO CROWD investors with an investment of €25,000 or more, with an IRR of 18%.

Waterfall of payments

In the payout hierarchy, YELDO CROWD investors have priority over the Sponsor.

After the repayment of the bank debt, the order of payments will be as follows:

- Capital and return of YELDO CROWD investors, who benefit from a preferential liquidation compared to the sponsor's junior equity

- Junior Equity and Sponsor Margin

Timeline

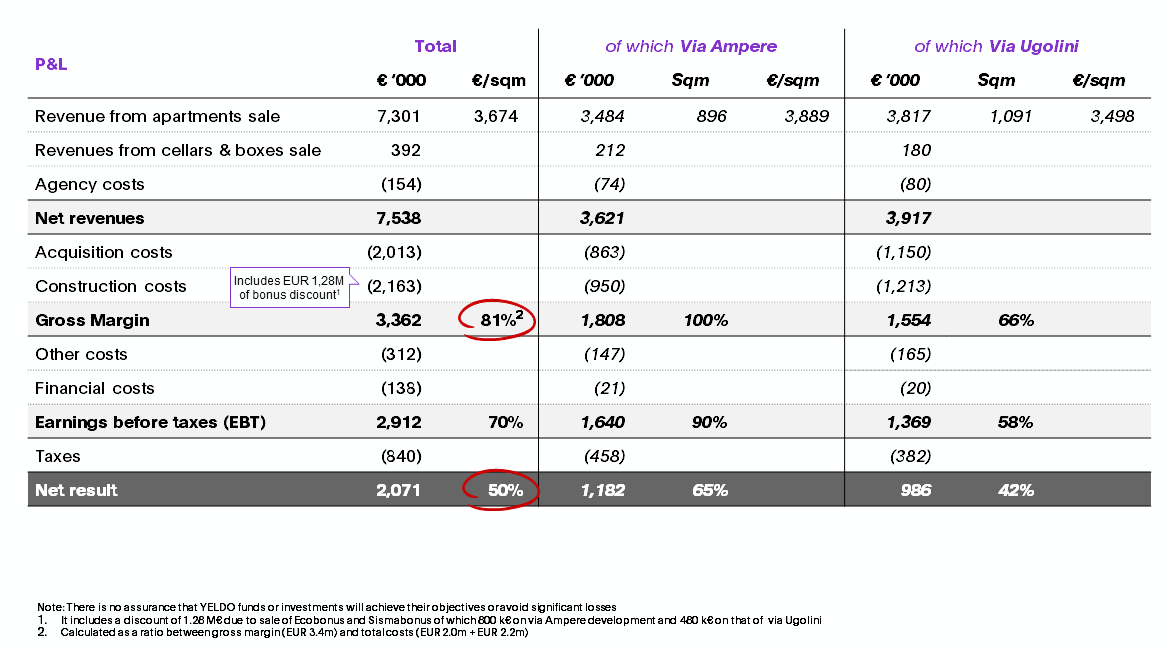

P&L

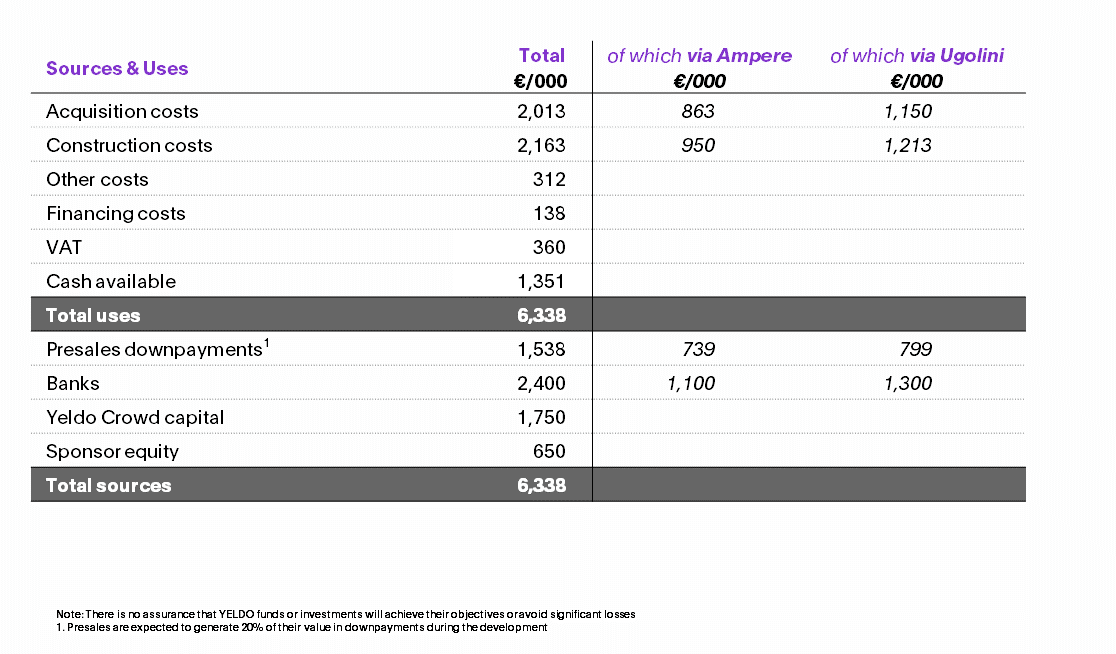

Sources and uses

Italian

Italian English

English