Milano, Missori : the project

Milan, Missori represents an investment opportunity in a project for the purchase, renovation and fractional sale of 5 residential units in via Falcone 5, in Milan, complete with luxury furnishings and finishes both for the interiors and for the terraces and balconies, in one of the most exclusive and central areas of the city of Milan: the Missori district. Investor funds will be used to finance part of the purchase and refurbishment costs (CAPEX). The main features of the project are the following:

- 16.7% ROI expected

- 13.0% IRR (Compounded Annual Rate)

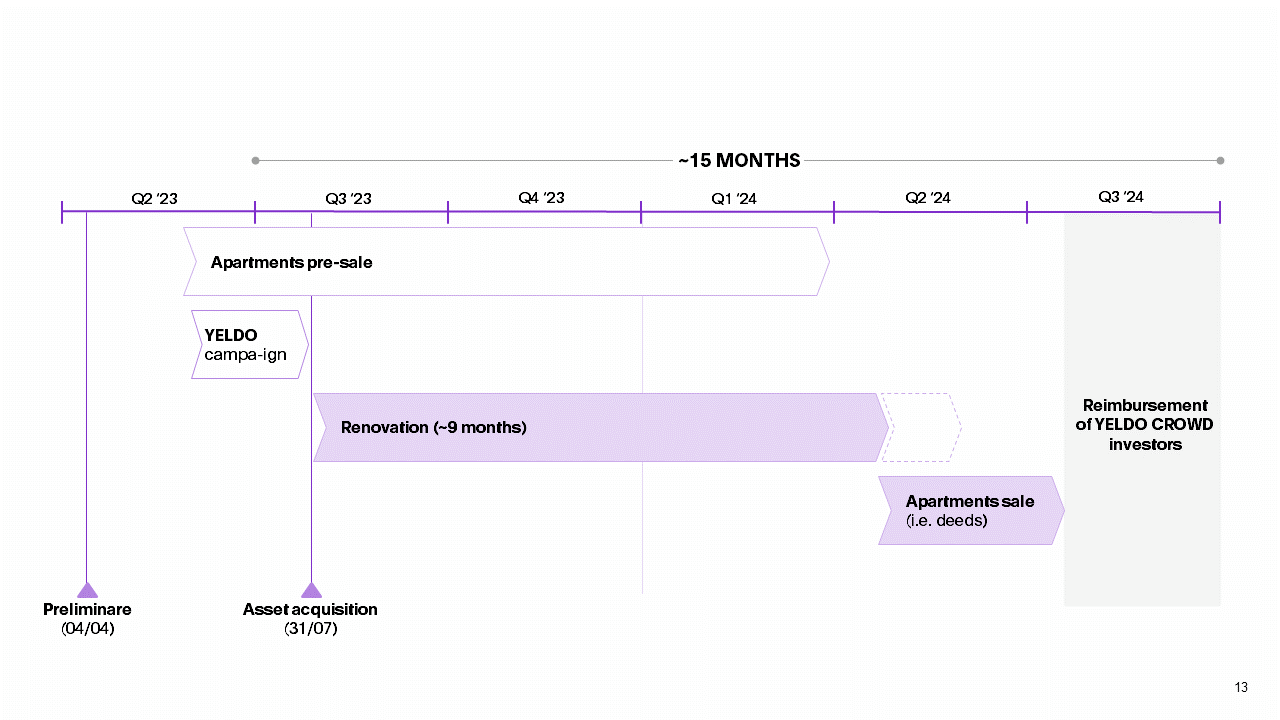

- 15 months expected holding period

- construction works start in August ’23, completion expected by Q2 ’24

The returns indicated are intended as expected returns, gross of the tax on the distribution during the redemption phase and the one-off investment fee:

- 1.5% for tickets under €25,000

- 1.0% for tickets greater than or equal to €25,000.

Executive Summary

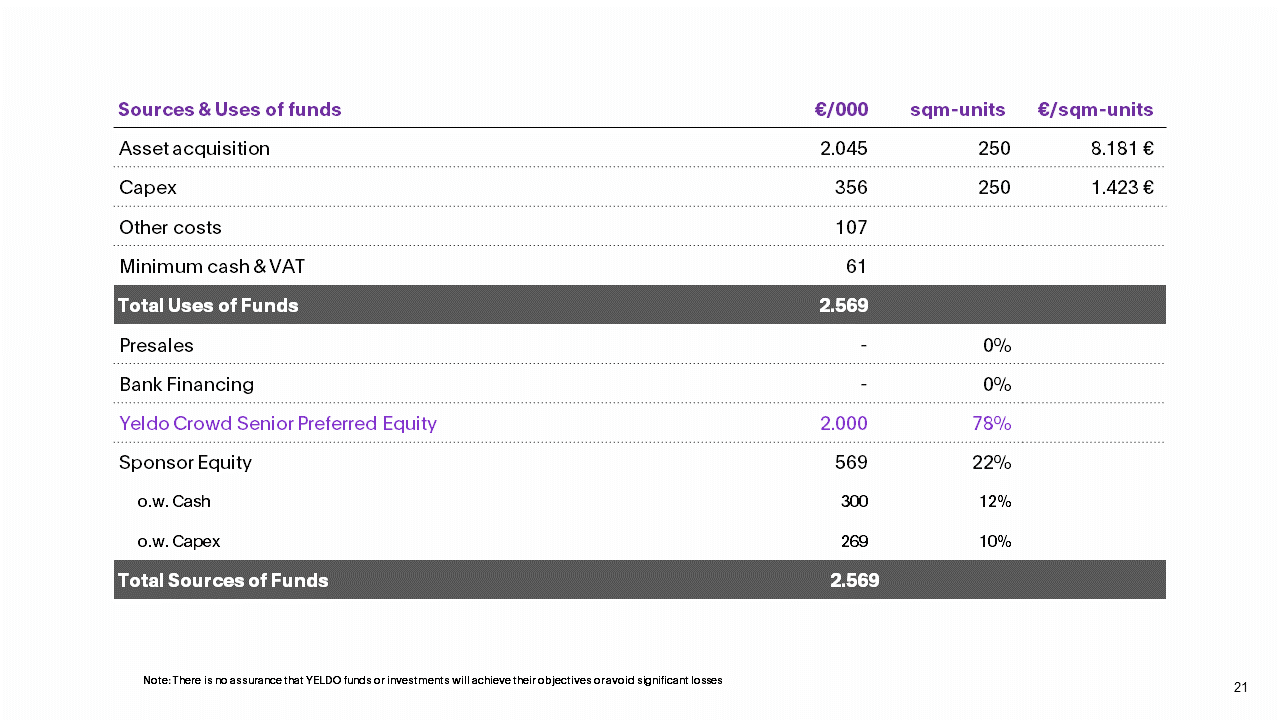

The invested funds will be used to finance part of the purchase of the property and the renovation costs associated with the project. The asset is purchased for €2.04m (including taxes and charges). The total contribution of the Sponsor is €569k of which €300k as cash and the remaining €269k as deferred payments to the company MY HOUSE. On 04/04/2023 a preliminary purchase agreement has already been stipulated and €130k as a confirmatory deposit has already been paid, while the remaining amount (€1.7m) will be paid upon deed, by 07/31/ 2023.

Strengths of the investment

-

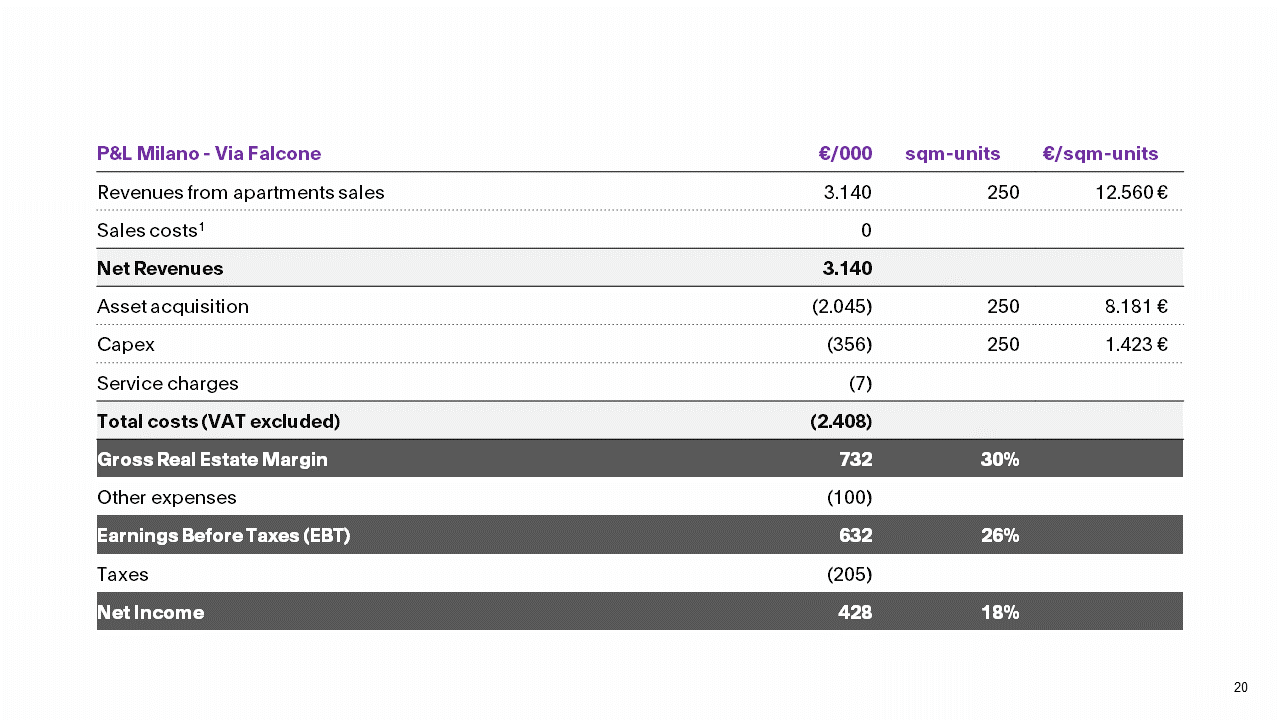

The project offers an attractive risk-return profile, with an estimated IRR of 13%, and a minimum cash on cash of 1.10x of invested capital. Gross margin is expected at 30% and expected net revenues of approximately €3.1m are expected to be achieved. The break-even point of the investors' capital is reached at 61.8%, with a sale price of merely €7.756/sqm (-38% compared to the business plan). YELDO investors benefit from a senior preferred position and a solid security package.

-

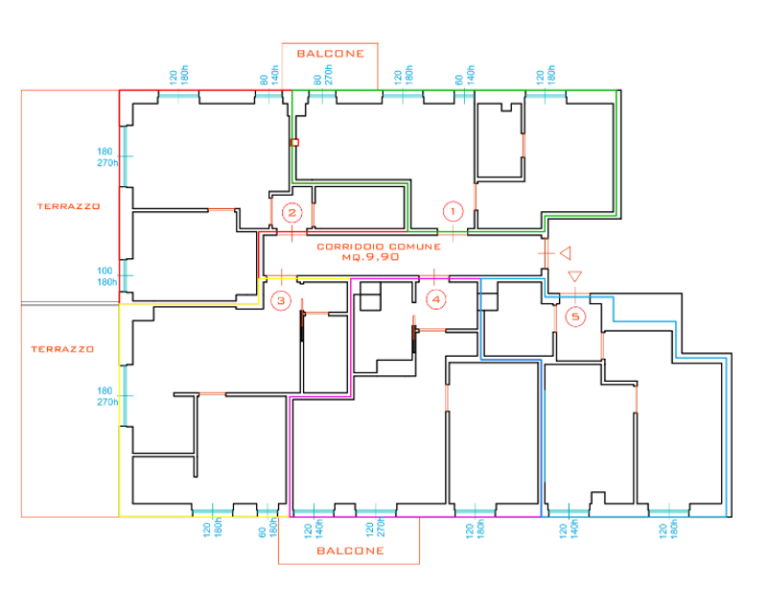

The project involves the acquisition and thee split of a large unit into 5 two-room flats located in Via Falcone 5, Missori, limiting the risk of renovation and the risk of commercialization. No major building permits needed, only CILA to be presented,(needed for minor works). It does not require a response from the Municipality but only serves to inform the public administration.

-

The area is among the most requested in Milan for high-end units and the apartments are exclusive luxury properties, two of which have large terraces and splendid views of the city skyline overlooking the Duomo.

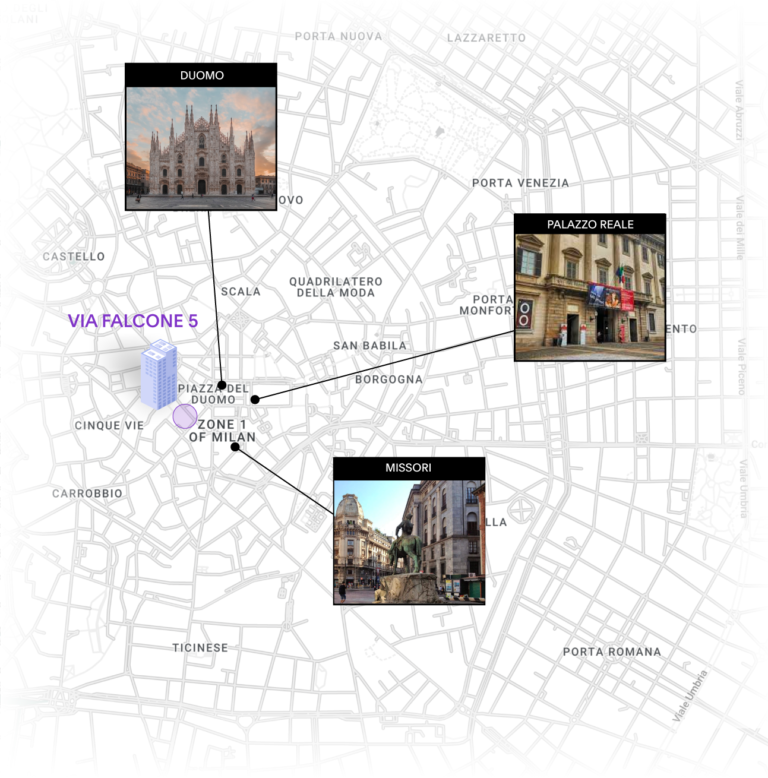

The Location

The property is located in the heart of the city of Milan, in the Missori district, a stone's throw from the Milan Cathedral and Piazza Diaz, Palazzo Reale, the Museo del Novecento, Torre Velasca.

The growing demand for new one bedroom apartments, especially with luxury finishes, in the central areas of Milan has reached unprecedented levels. In 2022 alone, real estate prices in these areas increased by 7.2% (Il Sole 24 Ore, Real Estate). This highlights buyers' continued interest in high-end, well-renovated residences.

However, the availability of new renovated one-bedroom apartments with luxury finishes is extremely limited, especially in these areas. This gives even more value to the asset in question, which stands out for its quality, design and attention to detail. The building represents a unique opportunity for those who wish to live in the pulsating heart of Milan, surrounded by architectural beauty and the lively cultural and social life that the city has to offer.

The Asset

Two of the five apartments will have panoramic terraces with one of the most exclusive views of Milan, overlooking the Duomo, the Church of Santa Maria and the beautiful city skyline.

The other two apartments will have large balconies, to enjoy an open space and a suggestive view. In total, there will be 3 cellars. Each apartment will be delivered complete with quality furnishings and ready for use: kitchen furnished with finely selected furniture, living room with high quality tables and sofas, as well as beds and wardrobes. Furthermore, already included there will be heating, air conditioning, washing machine and dryer.

The Sponsor

ED Investments and MY HOUSE have a solid track record which in recent years sees:

Over 20 projects for restructuring and subdivision6 months as the average duration for the completion of each project72 housing units renovated and sold overall

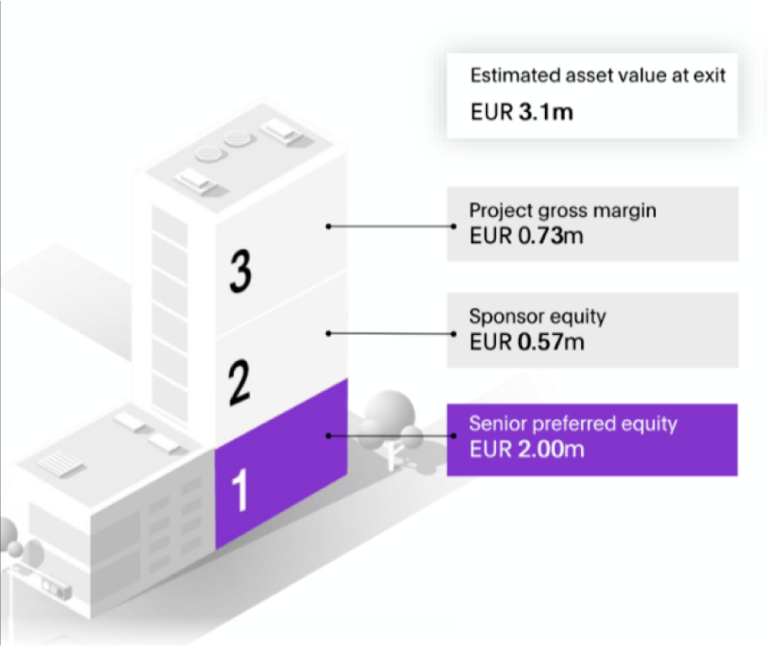

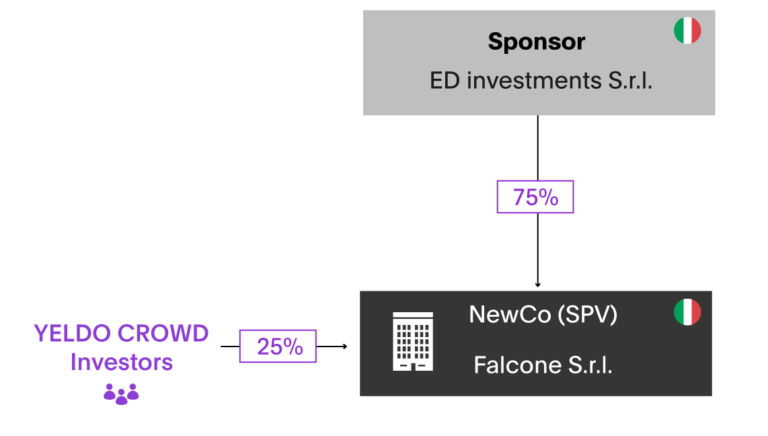

Capital structure

Class A: Sponsor ordinary shares, with full administrative rightsClass B: YELDO Investors, 13.0% IRR, with a 1.10x minimum cash on cash in case of early reimbursement.

Warranty package:

Liquidation preference: YELDO investors’ capital and return benefit from a liquidation preference vs Sponsor equityPre-sales: Before capital deployment, the Sponsor has to collect at least 2 purchase proposals and presents himself a purchase proposal for another unitChange of control: If YELDO investors are not reimbursed after 15 months, an investors-nominated Director will be appointed as sole director of the companyRevenues ring-fencing: Proceeds from apartments sales will be credited to a notary escrow account until full repayment of YELDO CROWD investors

Waterfall of payments

YELDO CROWD investors has a preferential position on both, invested capital and expected return, protected by €1.3m (sponsor's equity + gross margin).

In this project, YELDO CROWD investors assume a Senior position and therefore replace the bank debt.The waterfall of payments will be as follows: During the repayment phase, both the invested capital and the expected return of YELDO CROWD investors enjoy a liquidation preference, i.e. a priority of repayment with respect to the Sponsor's equity.

Given this preferential position, the break-even point, i.e. the level of sales required to repay YELDO CROWD's capital to investors, is 61.8%. This means that once 61.8% of the sales envisaged in the Business Plan have been reached, the repayment of the capital to YELDO CROWD investors will be guaranteed.

This payment structure favors the investors of YELDO CROWD and establishes an adequate protection of their capital invested in the operation.

Timeline

P&L

Profit and Loss

Italian

Italian English

English