Firenze, Via Chiusi :

the project

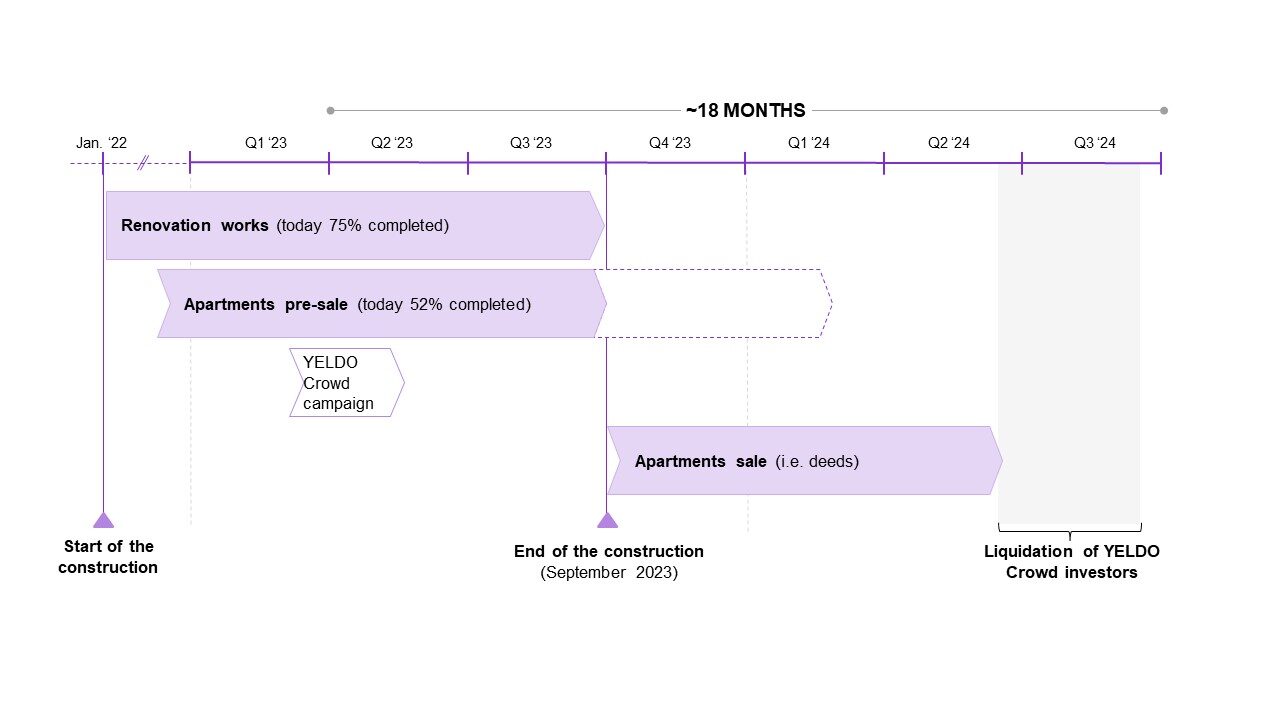

Florence, Via Chiusi 5 represents an investment opportunity in a renovation project of a free-standing property in a booming residential area. The project entails the renovation (75% completed) and the sale of 85 single apartment units, 52% of which have already been pre-sold. The investment will be used to finance, together with the Sponsor’s junior equity, the remaining construction costs. The expected duration of the investment is approximately 18 months (up to Q3 ’24), with an expected ROI of 18.6% and an expected IRR of 12.0%. Both the capital and the return will benefit from a liquidation preference over the Sponsor’s junior equity.

Executive summary

The initiative involves the renovation of a residential complex located in Via Chiusi 5 in Florence, built in 1980 by the Poste Italiane Group, and today acquired by Bluecap Srl, a company controlled by AD Casa Srl, equity Sponsor of the operation.

The project involves thefull renovation of the complex and the sale of 85 apartments (furnished with quality supplies) with relative covered and uncovered parking spaces. The operation includes also an energy efficiency operation, which takes the property from energy class G to A.

The renovation started in January 2022. To date,75% of the works have been completed and 52% of the housing units are pre-sold . The conclusion of the works is scheduled for September 2023 .

The project involves the

The renovation started in January 2022. To date,

Points of strength

The operation has numerous strong points:

- Advanced process: in the last few months the project has obtained all the necessary building permits and the construction site is now at a 75% state of progress (structural and external interventions have already been completed, the internal finishes of the units are under construction). Commercialization is well underway, with 52% of units already pre-sold

- Liquidation priority: thanks to the terms agreed with the equity sponsor, YELDO CROWD investors benefit from a liquidation preference, both on the invested capital and on the return, offering greater protection to YELDO CROWD investors

- Break-even point: given the current level of pre-sales, the break-even point at which YELDO CROWD investors get their investment back is €801/sqm on the remaining units, much lower than the market price, currently higher than €3,000/sqm

- Sponsor's track record: AD Casa, equity sponsor of the operation, is a real estate operator with many years of experience in development projects in Florence and Tuscany, having successfully concluded more than 40 developments since 2010 real estate

The asset

The Asset consists of a residential building with a characteristic L shape, developed on seven floors above ground as well as on a basement floor with technical room.

The project involves the construction of85 residential real estate units of small/medium size as well as 75 outdoor parking spaces, 9 covered parking spaces and 6 motorbike spaces, for a total commercial area of 5,235 m2 (4,919 m2 considering only the apartments).

The various floors are connected internally by 3 stairwells, one of which has a lift. All units will be done withmedium-high finishes. The specifications provide for floors inside the apartments in pre-finished parquet in the living/sleeping area, porcelain stoneware or single-fired tiles for the floors and walls in the bathrooms.

The heating/cooling system will be of the condominium heat pump type with meters inside the individual apartments. As part of theenergy efficiency intervention, photovoltaic panels were installed on the roof.

The project involves the construction of

The various floors are connected internally by 3 stairwells, one of which has a lift. All units will be done with

The heating/cooling system will be of the condominium heat pump type with meters inside the individual apartments. As part of the

The location

The asset is located in Florence, in Via Chiusi 5 , in a semi-central residential district undergoing strong development, which has experienced a 5-10% growth in market values equal over the last year.

The complex is located6.5 km from the historic center of Florence (15 minutes by car) in a predominantly residential area full of greenery

The property is in a well-connected areawith neaby public transport and essential services : in close proximity there are bus and tram lines, supermarkets (within 100m), medical and health facilities, sports and recreational centers, public parks.

Florence'sairport is only 7 minutes away by car, while the entrance to the A1 highway is only 10 minutes away .

The complex is located

The property is in a well-connected area

Florence's

The sponsor

The sponsor of the operation is Gruppo AD Casa, a real estate operator with many years of experience in development projects in Florence and Tuscany.

AD Casa track record sees:

AD Casa track record sees:

- 15+ years of experience, making AD Casa one of the most consolidated real estate developers in the Florence area

- 40+ real estate developments since 2010 by companies headed by AD Casa

- €170M market value of ongoing real estate developments of the AD Casa Group at the end of 2022

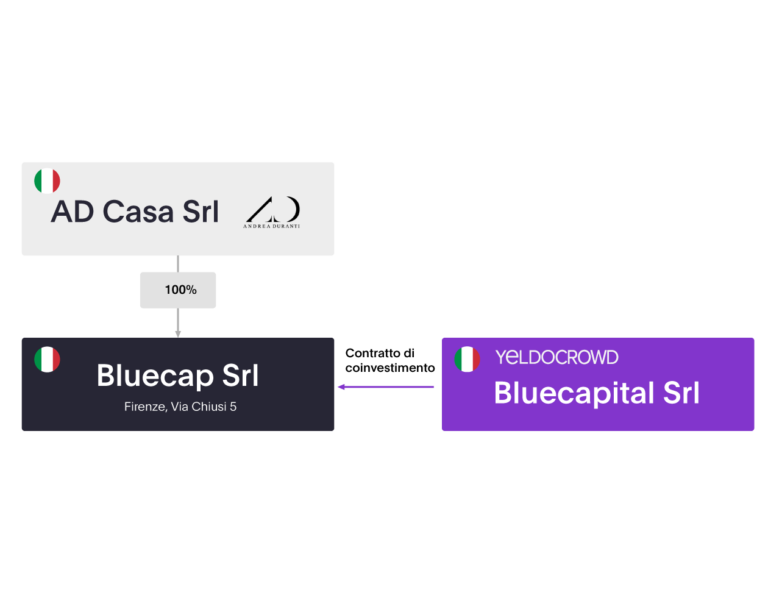

Deal structure

Capital Structure

- Bluecapital Srl is a special purpose company established with the aim of welcoming YELDO CROWD investors for the real estate transaction in via Chiusi Florence

- YELDO CROWD investors become holders of "B Units" of Bluecapital Srl acquiring 35.7-45.5% of the share capital (depending on the total amount raised with the crowdfunding campaign)

- The “B Shares” entail a preferential distribution of 99% of the profits of Bluecapital Srl

- Bluecapital Srl deploys the funds to Bluecap Srl, owner of the asset, through a co-investment contract

- Upon accrual of the profit, Bluecap Srl reimburses Bluecapital Srl, which is put into liquidation, thus reimbursing YELDO CROWD investors

- The co-investment contract entails that both the capital and the interests of Bluecapital Srl benefit from a liquidation preference vs. the Sponsor's equity within Bluecap Srl

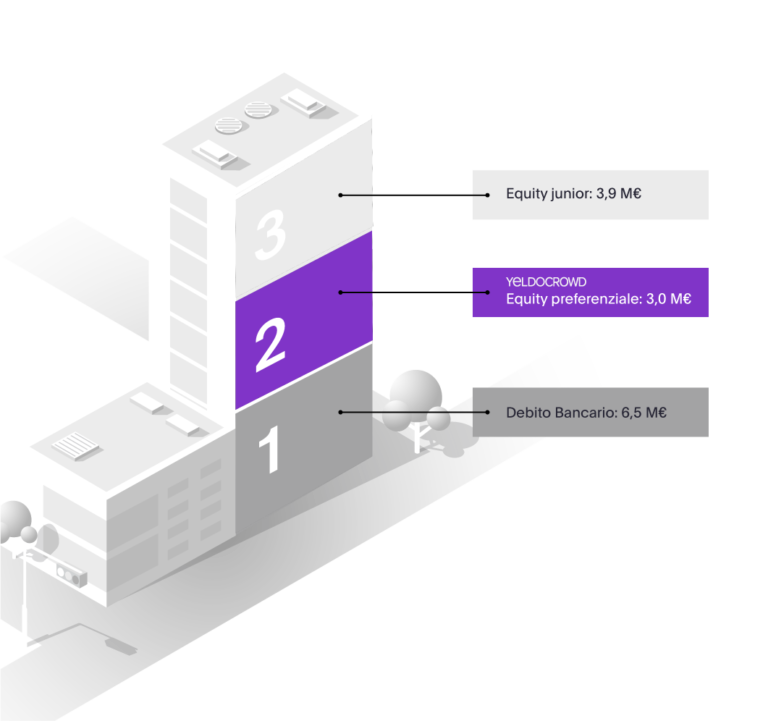

Waterfall of payments

In the waterfall of payments, YELDO CROWD investors enjoy a priority over the Sponsor.

After the repayment of the bank debt, the order of payments will include:

The break-even point, i.e. the percentage of sales vs Business Plan to be carried out to repay the capital of YELDO CROWD investors is equal to 62.4% (current pre-sales level equal to 52%), equivalent to a sale price equal to at €801/sqm on the remaining area to be sold

After the repayment of the bank debt, the order of payments will include:

- YELDO CROWD Investor Capital (Preferential Equity)

- Expected Return of YELDO CROWD Investors

- Junior Equity and Sponsor Margin

The break-even point, i.e. the percentage of sales vs Business Plan to be carried out to repay the capital of YELDO CROWD investors is equal to 62.4% (current pre-sales level equal to 52%), equivalent to a sale price equal to at €801/sqm on the remaining area to be sold

Timeline

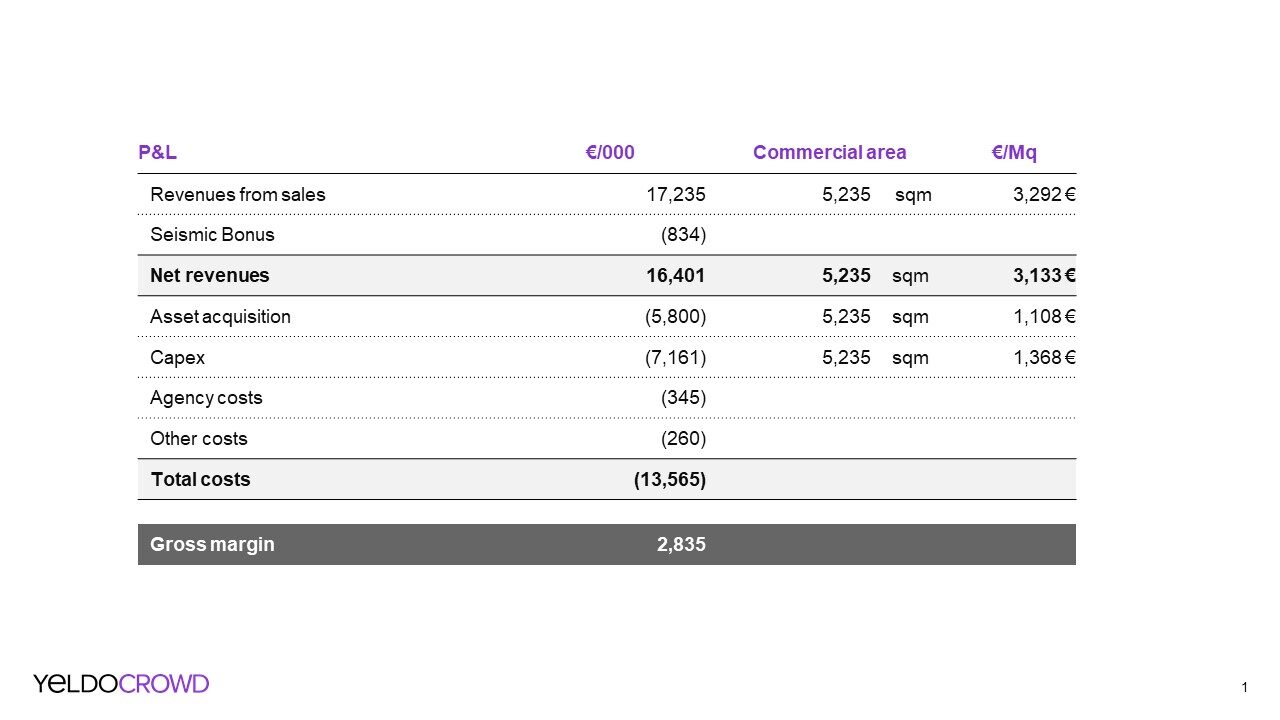

Profit and Loss Statement

Italian

Italian English

English